Quote of the week

“Simplicity is the ultimate sophistication.”

- Leonardo da Vinci

Edition 49 - December 7, 2025

“Simplicity is the ultimate sophistication.”

- Leonardo da Vinci

Over the last couple of years, something interesting has been happening: more people - especially developers, tech YouTubers, and even some gamers - are switching from Windows or macOS to Linux. One of the biggest examples is PewDiePie, who devoted an entire video to his move. And he’s not alone.

So…why is this happening? And should you consider switching?

🚀 What’s Driving the Shift?

1. Windows Fatigue

Windows 10’s retirement pushed many people toward Windows 11 - and not everyone’s thrilled with what they found. Common complaints include:

● Bloatware and forced AI integrations

● Restricted control (e.g., odd permission issues, difficult file management)

● A general feeling of “being pushed around” by the OS

2. macOS Limitations

Developers still love macOS, but recurring gripes include:

● The unavoidable constraints of a non–open-source ecosystem

● Lack of gaming compatibility

macOS is polished - but you can’t shape it into exactly what you want.

3. Linux is Better Than Ever

Linux used to be seen as “cool but impractical.” That’s changed.

● It’s free (Windows is now ~$140).

● It runs on virtually any hardware, from a $100 laptop to a custom PC.

● You can pick a distribution (essentially different flavors of Linux built for different needs) that matches your vibe:

○ Ubuntu - beginner-friendly

○ Fedora - polished and modern

○ Pop!_OS - loved by devs

○ Arch - ultra-customizable (“I use Arch btw”)

■ Omarchy - a clean, modern setup built on Arch. This is what I have recently been using and enjoying!

○ And so many more (sorry if your personal favorite wasn’t mentioned!)

And gaming? Surprisingly solid now. Thanks to Valve’s Proton compatibility layer, Steam reports that over 10,000 games now run on Linux, many flawlessly.

I’ve personally played Hades II, Balatro, and several other titles on my dual-boot Linux PC with minimal issues.

❓ So… Should You Switch?

Try Linux if:

● You’re curious about the open-source world

● You don’t mind tinkering with settings or the terminal

● You’re a developer - most backend tools run on Linux anyway

● You have an old laptop you want to revive

● You want a fast, bloat-free OS you can shape to your liking

Maybe don’t switch if:

● You don’t want to troubleshoot or customize things

● You’re a heavy gamer with competitive titles

● You rely on software that only exists on macOS/Windows

For gamers, Linux is closing in, but Windows still has the edge.

🧭 Final Thoughts

The rise of Linux isn’t a mass exodus, but it is a real movement. Frustration with closed ecosystems plus the growing polish of Linux distributions have made switching more accessible - and more appealing - than ever.

If you’ve been curious, now’s the best time in history to give Linux a shot. Worst case? You dual-boot, learn a few new tricks, and go back. Best case? You discover an OS that feels fast, free, customizable, and genuinely fun to use.

My prediction? Linux will keep growing steadily among programmers and technically curious gamers as tools, distros, and gaming support improve — but most casual users will stick with Windows and macOS for the near future, simply because those ecosystems remain the most convenient and familiar.

Netflix’s move to acquire Warner Bros. Discovery is one of the most significant shifts in modern Hollywood. The deal gives Netflix control of a vast catalog of films, television series, and franchises that helped define multiple eras of entertainment. It also positions Netflix far beyond its origins as a streaming platform. With access to a major studio’s output and infrastructure, the company becomes a central force in how content is created and distributed.

The importance of this moment lies in scale. For years, Netflix was the outsider pushing traditional studios to rethink their strategies. Now it owns one of the biggest studios in the industry. That jump changes the competitive landscape. Netflix gains not just intellectual property but decades of production expertise and global distribution pipelines. It becomes harder for smaller streamers to keep up, and the gap between the industry’s largest players widens.

This deal also signals a strategic shift across Hollywood. Studios and streamers have been searching for sustainable business models in an environment shaped by rising costs and fragmented audiences. Consolidation offers a quick path to stability. Netflix’s acquisition could accelerate that trend as competitors decide whether to merge, sell, or double down on niches. It may also reshape decisions about theatrical windows, franchise investment, and how studios develop long term talent relationships.

The move brings uncertainty. Regulators will likely scrutinize the transaction because it concentrates creative and commercial power in fewer hands. Creators may gain a larger global platform but face tighter control over budgets and distribution options. Audiences could benefit from stronger franchises and deeper libraries, although innovation sometimes slows when markets consolidate. What is clear is that Netflix’s acquisition marks the beginning of a new chapter for Hollywood, one defined by scale, integration, and a race to control the future of entertainment. Note: The deal has not closed yet and remains subject to regulatory approval.

Frontier models are already specializing, and it is starting to look less like a single race and more like a league. OpenAI still owns most of the consumer mindshare, with ChatGPT as the default AI app for a huge chunk of the world. Anthropic is steadily becoming the engineer’s and operator’s model, with strong traction in enterprises that care about reliability, structured reasoning, and code. Google is turning Gemini into the AI layer inside its data and productivity stack. xAI is leaning hard into real time current events through its deep integration with X. Amazon, through Bedrock and its growing model ecosystem, is trying to become the place where companies build and host their own custom models instead of renting a single general one. It is hard to look at that landscape and still believe there will be one model to rule them all.

OpenAI’s position is powerful but narrow. It is winning the consumer assistant slot, but it does not control the operating systems, productivity suites, or the main cloud platforms where people work all day. Google does. Google can cross subsidize Gemini across Search, Android, Chrome, and Workspace and treat it as defensive armor around its ad and cloud businesses. That is why the idea of a very cheap or nearly unlimited Gemini tier aimed at students, developers, or emerging markets makes strategic sense, even if today’s full unlimited free model is not on the table. If OpenAI stays primarily a direct to consumer product while Google quietly makes a “good enough” assistant the default on every surface it owns, then OpenAI’s lead becomes less about long term dominance and more about being first to popularize the category.

The rest of the field is not trying to copy this consumer versus distribution duel. Anthropic is optimizing for trust, code quality, and complex multi step work, then selling that into enterprises that care about governance and vendor risk more than viral growth. xAI is positioning Grok as the system you ask about what is happening right now in markets, culture, and politics, with a personality tuned to the X audience rather than a neutral assistant. Amazon is not chasing a household brand right now. Its bet is that many companies will want models that live inside their own virtual private clouds, speak the private language of their data, and can be swapped out or combined as better base models appear. These strategies look different, but they are all rational responses to the same question: where do you already have distribution and leverage.

If this pattern holds, most organizations will not standardize on a single frontier model. They will build a portfolio. OpenAI or Google for general purpose chat and research. Anthropic for tightly integrated coding and agents. An Amazon hosted model distilled on internal data. Maybe xAI for live risk and sentiment checks on public information. On the consumer side, the “one app” fantasy also breaks once people see how easy it is to bounce between tools that each have a distinct personality and strength. The real contest is not to become the One Ring of artificial intelligence. It is to become the ring that sits on a specific finger and never gets taken off because it fits a particular job so well that switching stops making sense.

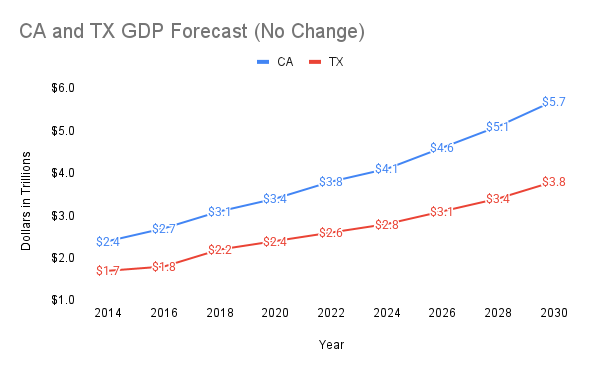

Texas is already closer in GDP to California than most people think. A decade ago, the gap between their economies looked enormous. Today, Texas has grown into an almost three trillion dollar heavyweight that now sits roughly two thirds the size of California’s economy. Over that same period, Texas has consistently posted stronger real growth and shows no signs of slowing. When you chart the last ten years, you see two global scale economies on different trajectories. One is maturing under its own weight. The other is accelerating with room to run. This first chart shows real GDP for both CA and TX over time, with growth projections into the future based on historical data alone.

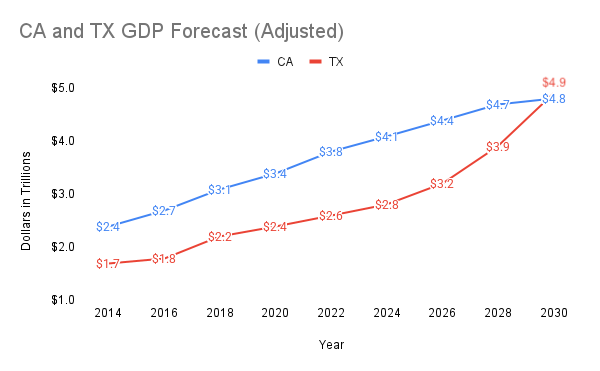

The corporate migration tells the story more cleanly than any statistic. Tesla, Oracle, Hewlett Packard Enterprise, McKesson, Charles Schwab, and a wave of other household names have moved their headquarters from California to Texas. Each relocation brings executives, suppliers, and high value services that compound over time. These companies are not chasing marginal advantages. They are responding to a structural shift in where it makes sense to build the future. This next chart shows real GDP for both CA and TX over time, with my prediction of growth into the next 5 years.

Incentives drive that shift. California leans on high taxes, dense regulation, and an expanding set of social programs that increase the cost of doing business. Texas takes the opposite approach. It has no personal income tax, a more predictable regulatory climate, and targeted incentives for manufacturing and research. California tries to steer markets from the top down with an increasingly ideological framework. Texas focuses on lowering friction and letting markets work. The results show up in investment decisions long before they show up in GDP tables.

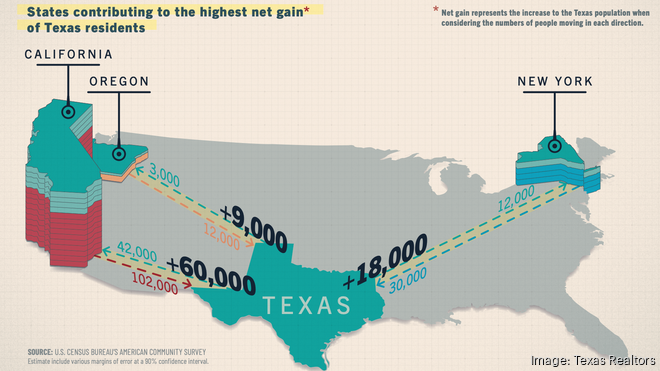

People move for the same reasons companies do. California continues to lose residents to other states, especially working professionals who want more housing, lower taxes, and fewer hurdles. Texas absorbs that inflow with relative ease because it builds fast and expands infrastructure when needed. The difference in housing supply alone explains why young families, remote workers, and even founders find Texas a more durable home base. Growth compounds when people can afford to stay and build.

All of this sets up my straightforward five year prediction. Texas does not need heroic growth to catch California. It only needs to keep doing what it has done for the last decade: attract companies, attract people, and deploy capital with fewer constraints. California will remain a center of innovation, but its operating model is becoming heavier and more brittle. If the dramatic differences between these two states hold, the next headline is obvious. Texas will surpass California in GDP by 2030.

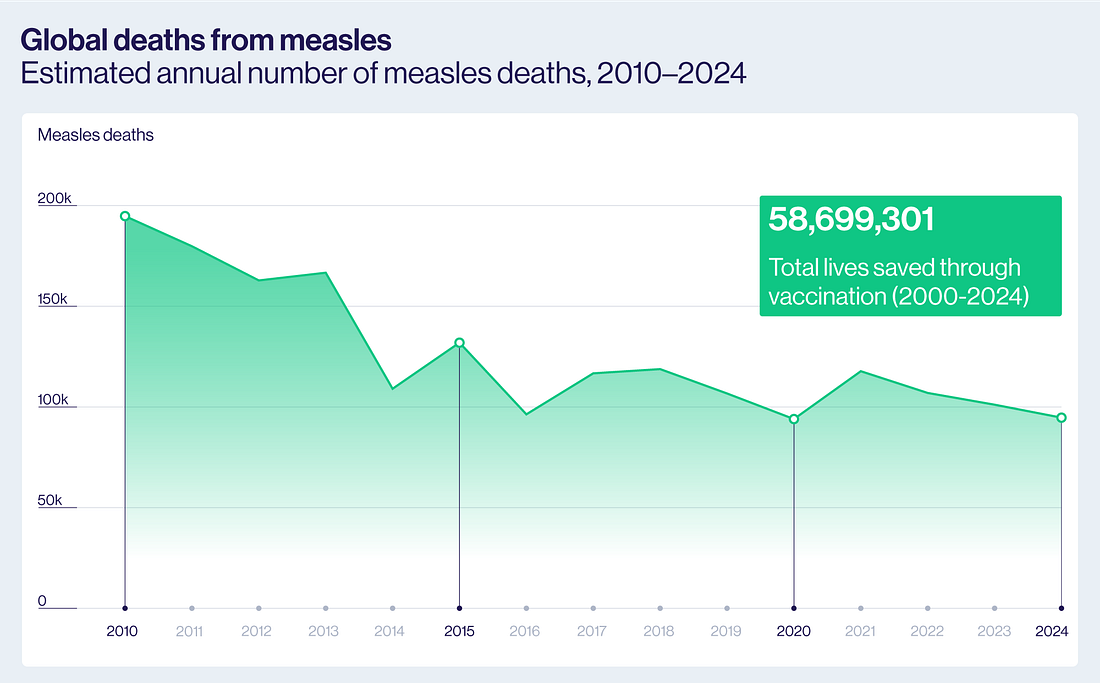

Humanity is winning its long battle against measles. A new WHO report shows annual deaths have plunged by 88 percent since 2000, dropping from 777,000 a year to 95,000. Vaccination efforts have saved an estimated 58 million lives over that period. Routine immunisation has strengthened global immunity, with second-dose coverage climbing from 17 percent to 76 percent and creating major gains across Africa. The work is not finished though. Last year 20.6 million children missed their first dose, fueling outbreaks in 59 countries and reminding us how vital continued progress remains.

A major boost is coming for America’s newest savers. A $6.25 billion gift is helping launch federal “Trump accounts” for children born from 2025 to 2028. Each child will receive a $1,000 government deposit invested in an index fund that grows until adulthood. Families and others can contribute up to $5,000 a year until the child turns 18. Michael and Susan Dell will add another $250 for children living in zip codes where the median family income is $150,000 or less. The hope is that this jump-start inspires more donors to join in and keep building the next generation’s financial foundation.

The Democratic Republic of Congo and Rwanda have endorsed a US-brokered peace agreement, a step many hope will ease long-running tensions in the region. Both governments have committed to withdrawing foreign troops and dismantling the FDLR militia group. Analysts note that the lack of a stable ceasefire limits the immediate effect, yet the agreement still marks meaningful diplomatic progress. President Trump has positioned the deal as an early step toward significant new investment in Congo’s mineral sector, raising hopes for greater stability and economic opportunity in the years ahead.

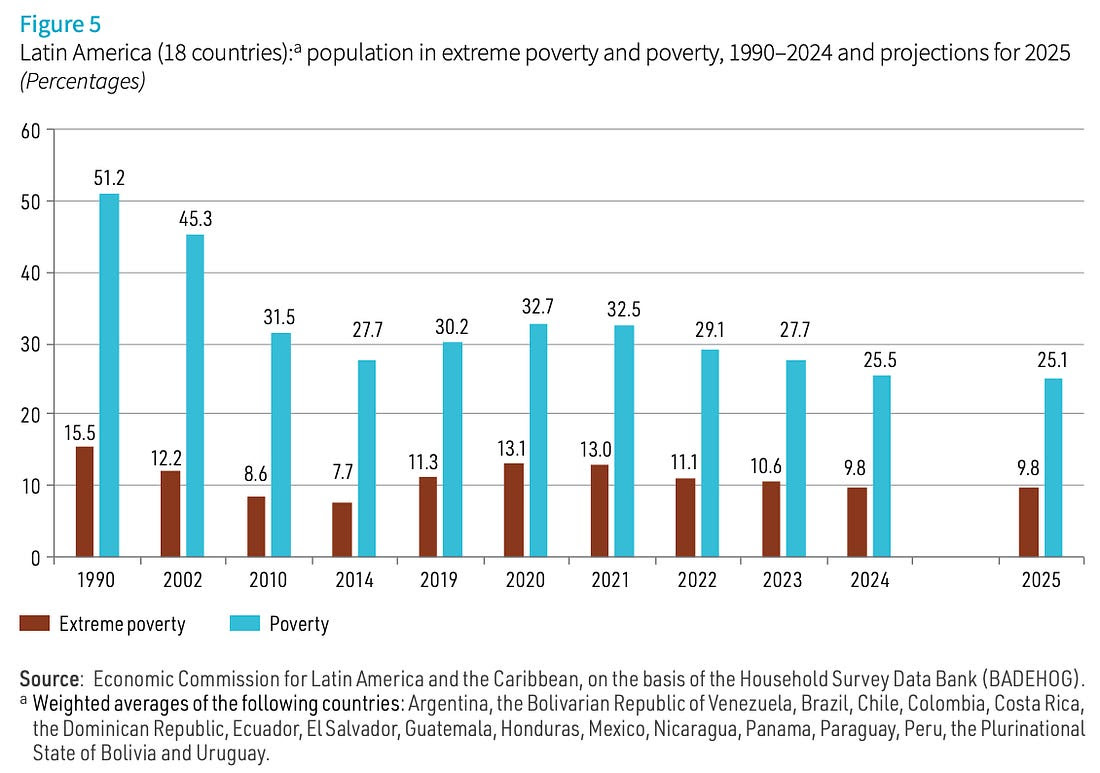

Kerala, a state of more than 60 million people in India, reports that it has eliminated extreme poverty after reducing rates from more than 60 percent in the 1970s to nearly zero today through long-term investments in literacy, health and targeted programs that deliver food, housing, medical care, education support and job cards. That momentum is echoed elsewhere: Vietnam has cut its multidimensional poverty rate to 1.3 percent, down from 4.4 percent three years ago, Tajikistan has reduced national poverty from 56 percent in 2010 to about 20 percent today and Latin America has reached a record low poverty rate of 25.5 percent in 2024, a 2.2 percent drop since last year that translates to 12 million people moving out of poverty, driven largely by rising wages in Mexico and Brazil.

Enjoying The Hillsberg Report? Share it with friends who might find it valuable!

Haven't signed up for the weekly notification?

Subscribe Now