Quote of the week

“Knowledge speaks, but wisdom listens.”

- Jimi Hendrix

Edition 43 - October 26, 2025

“Knowledge speaks, but wisdom listens.”

- Jimi Hendrix

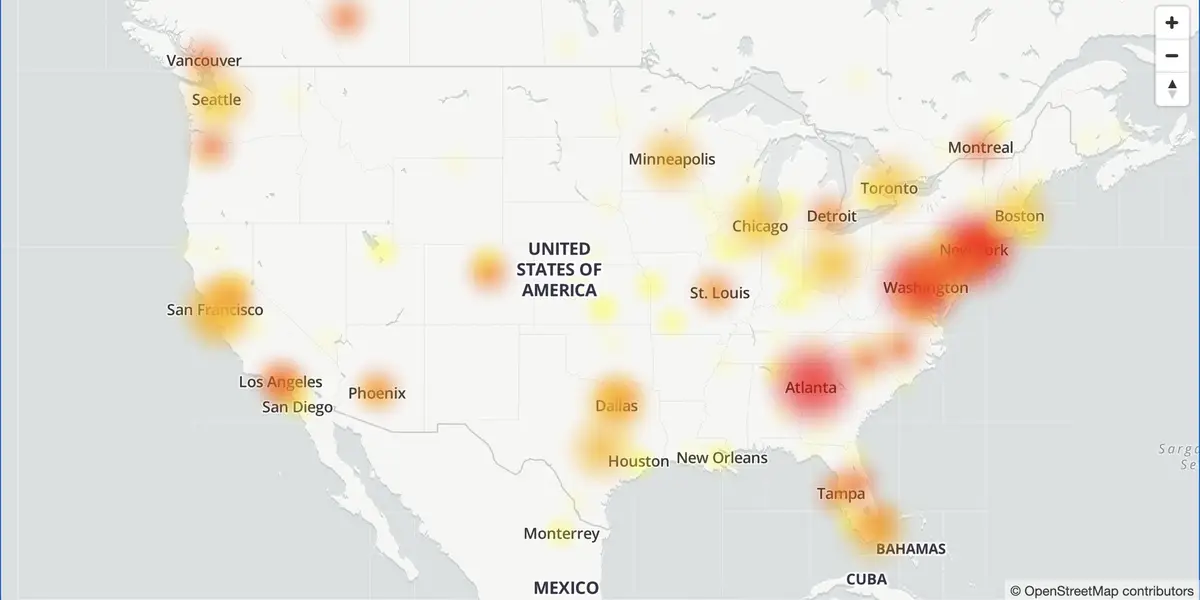

On October 20 a failure in AWS’s US East 1 region rolled through the internet like a squall line. Error rates spiked just after midnight Pacific. Within minutes consumer apps, enterprise dashboards, and even smart home gadgets began timing out. What looked at first like a noisy blip turned into a systemic incident as customers could not resolve the endpoints they needed to talk to. By early morning Eastern, Fortnite, Snapchat, Alexa, and a long list of business services were in varying states of broken. AWS began mitigation in the small hours and signaled full service restoration later in the day, but the backlog of retries and delayed jobs kept the pain alive for hours after the headline fix.

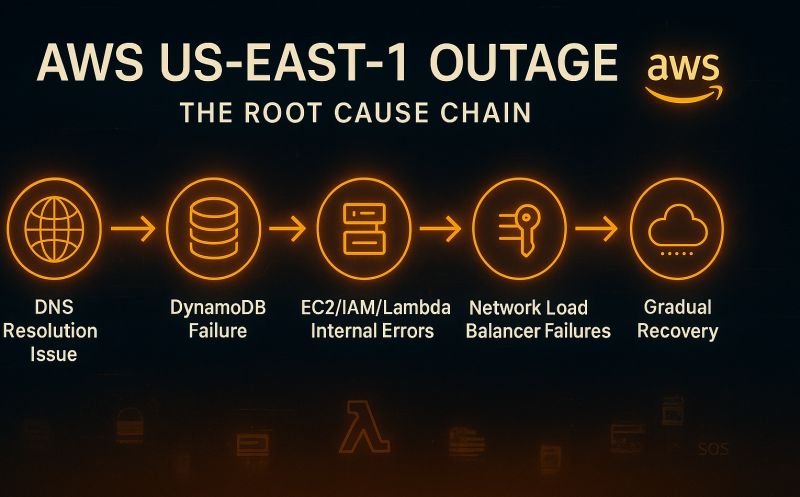

The root cause landed squarely in DNS for DynamoDB’s regional endpoint. AWS operates an automated system that plans and applies DNS changes for foundational services. Think of it as two jobs. One planner composes the map of which IPs and health checks should serve a given endpoint. One enactor applies that map to Route 53 so clients can resolve and connect. On Sunday night a rare timing bug let two enactors step on each other’s toes. One moved slowly, another moved ahead, and a cleanup routine removed what it believed were stale records. The end state was the worst possible case for a control plane that depends on DynamoDB. The active DNS record for the DynamoDB API in US East 1 ended up empty. No addresses meant no connections, and no connections meant a lot more than databases stopped working.

Once DNS for DynamoDB fell over, the failures cascaded in classic cloud fashion. EC2’s internal lease manager tried to reconcile instance state across a huge fleet and could not. New instance launches struggled. Network configuration changes piled up. Network Load Balancer health checks began ejecting instances that could not pass checks during network delays, then later readmitted them, which meant flapping behavior across dependent services. Serverless platforms like Lambda and container services like ECS and EKS all showed symptoms because they sit on top of EC2 and DynamoDB for orchestration. Even after AWS fixed the bad DNS state and turned automation back on with guardrails, engineering teams had to throttle parts of the platform to clear queues safely. The visible outage window was measured in hours. The cleanup and quiet tail were longer.

If you are a CIO or a staff engineer, the lesson writes itself. Single cloud and single region thinking is not resilience, it is concentration risk with a friendly UI. An outage that starts as a DNS blip in one service can strand entire businesses when that service sits under your control plane. Multi region helps, but many teams still anchor everything to US East 1 because it is the default and because many managed services are deeply tied to it. The pragmatic next step is diversification at two levels. Split critical workloads across regions and also across at least two providers for the pieces that must never be dark at the same time. Plan for graceful degradation when a provider’s control plane is congested. Assume that retries will become avalanches. Test failover in business hours, not during a live fire.

This opens a lane for an abstraction layer that treats AWS, Azure, and Google Cloud as interchangeable back ends for most of what you do. The shape of that tool is already visible. A global ingress and load balancing tier that can steer traffic between clouds. A portable runtime based on Kubernetes, with a control plane that can stamp out identical clusters and policies across providers. A cloud neutral configuration stack that declares infrastructure once and targets many. A data layer that supports replication across clouds, with controlled consistency and explicit failover runbooks. A multi cloud network fabric that presents one routing and security model over many provider primitives. You can assemble much of this today with Cloudflare for global traffic management, Kubernetes plus Crossplane for a universal control plane, Terraform for provisioning, and Aviatrix or similar for network abstraction. Vendors like Google Anthos, Azure Arc, VMware Aria, and Morpheus Data offer opinionated platforms that package many of these ideas. None of these deliver a perfect one click cloud dial yet. The real opportunity is a product that bakes health probes, cost signals, identity, policy, and data movement into a single pane that flips you from failover theory to provable practice. Will you build it?

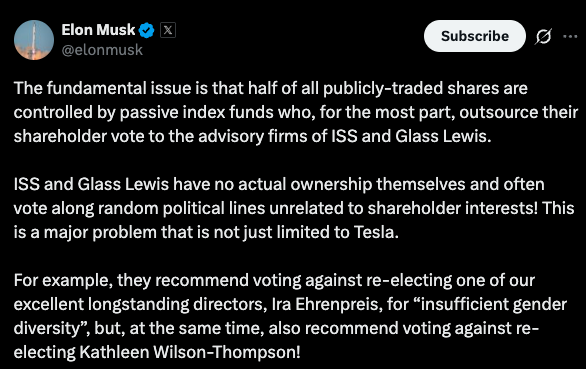

This week Elon Musk lit up X with posts and comments aimed at the two biggest proxy advisory firms, Glass Lewis and Institutional Shareholder Services. He blasted both after they recommended that Tesla shareholders vote against his proposed pay package, calling them corporate terrorists and urging investors to take back their votes from proxy advisors. The volley came alongside fresh headlines that ISS and Glass Lewis had advised a no vote, while a smaller firm, Egan Jones, offered only partial support under one of its policies. The dispute is front and center ahead of Tesla’s fall shareholder vote and it has pulled the mechanics of proxy voting into the spotlight.

ISS and Glass Lewis are research and advice shops that analyze thousands of annual and special meetings, publish vote recommendations on directors, pay, mergers, and shareholder proposals, and provide tools that let institutions execute votes at scale. ISS was founded in 1985 and today is majority owned by Deutsche Börse Group, positioning itself as a data and stewardship platform for investors and companies. Glass Lewis launched in 2003 and describes its mission as independent governance research, data driven insights, and proxy voting solutions. Their core mission statements have stayed consistent, but the product scope has expanded over time into stewardship services, ESG policy frameworks, and technology that pipes policies directly into clients’ voting systems.

Where the influence comes from is the plumbing. Large institutions hold positions in nearly every public company and face overlapping meeting dates and thousands of ballot items. Most buy research from ISS and Glass Lewis and then map that research to a house policy or one of many third party policies. The advisors’ reports surface red flags and provide a default recommendation that can be accepted, overridden, or customized. Because index managers and other diversified funds vote across the market, a recommendation from either firm can shape outcomes at scale when many clients apply the same policy across portfolios. That is why a negative recommendation against a marquee item, like the Tesla pay package, becomes immediate news and a flashpoint for companies and investors alike.

Who actually owns the votes for index fund investors depends on structure and law. In the US, the fund is the shareholder of record in the portfolio companies and the investment adviser votes those shares as a fiduciary. This means that if you own a Vanguard ETF, Vanguard gets to vote on your share. SEC rules require advisers that vote client proxies to adopt and disclose policies to vote in clients’ best interests, keep records, and tell clients how to obtain voting information. The SEC has also updated guidance around proxy voting advice businesses and investment adviser obligations, clarifying how advice is regulated without dictating outcomes. Retail investors in mutual funds and ETFs generally do not own the underlying company votes directly; they own fund shares and can vote on fund level matters. Some large managers have begun offering pass through or policy choice programs that let certain investors direct how their pro rata slice of fund shares is voted, such as BlackRock Voting Choice and Vanguard Investor Choice, but these are programmatic options offered by the fund sponsor rather than a transfer of legal ownership of the votes.

In the new world of decentralized finance, I'd like to see this completely overhauled. If I own a fraction of a share, even through a fund, I want to own the vote. Simply weigh my vote based on how many shares I own. You could do this even for fractional shares. To me, this is un-democratic and a big issue for the United States which I've never seen get any attention.

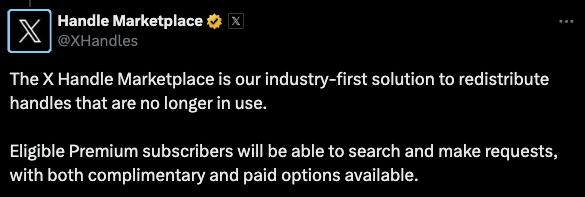

X is launching a marketplace for inactive handles, making unused usernames available to paying members. The company frames it as a structured way to request names that have sat idle, with eligibility, reviews, and pricing handled in product.

Why do this now? It turns a dormant asset into a perk for subscribers and a new revenue line for the platform. It also reduces username squatting, gives brands cleaner identity options, and nudges users toward higher tiers. In short, it converts abandoned names into utility and cash.

I have felt this pain personally. I once chased the perfect domain and the matching handle, only to find an inactive owner with no contact path and no way to ever get it. A built in marketplace fixes that. It lets platforms reallocate idle digital real estate with a simple feature, while creating a small but steady stream of revenue. It's a simple feature with high upside and I'm blown away other companies haven't employed it before.

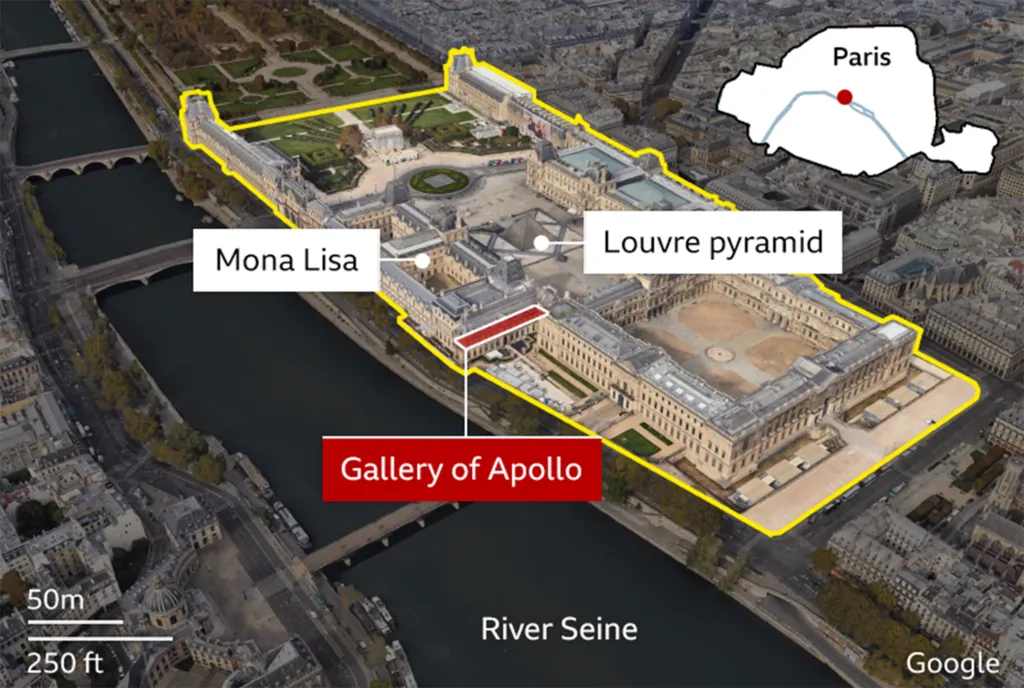

In a startling daylight raid at the Louvre, a crew in construction gear used a truck mounted lift to reach a second floor window, cut their way in, and sprinted to the Galerie d’Apollon where France keeps its crown jewels. According to the BBC’s account, alarms sounded as cases were smashed and the thieves moved with chilling precision before bolting into the streets of Paris. You can read the report here via BBC News.

The haul was small in number and massive in significance. Eight jewels tied to 19th century royalty, including pieces linked to Empress Eugénie and Queen Hortense, were snatched in minutes. One crown was dropped and damaged during the escape, but officials stressed that the cultural loss far outweighs any estimate in euros, since these objects anchor a story that runs from Napoleon to modern Paris.

Investigators are now combing footage, interviewing staff, and tracing the lift and getaway route as France debates how a world famous museum could be hit so cleanly and so quickly. The incident spotlights a familiar tension for cultural landmarks in busy cities. Doors must stay open for the world, yet protection has to be strong enough to stop a crew that plans for speed and vanishes just as fast.

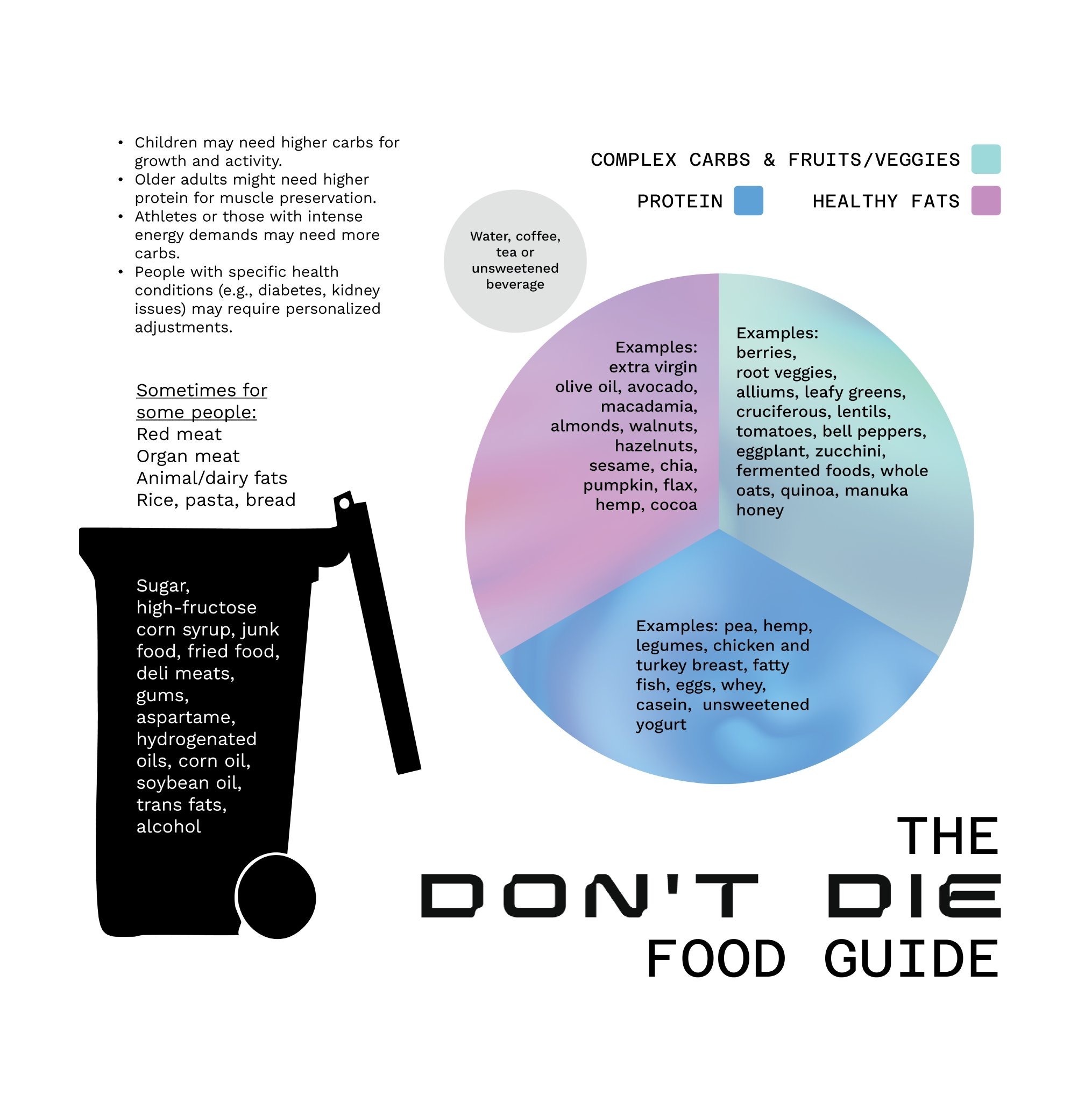

Bryan Johnson is a tech entrepreneur who founded Braintree and later created Blueprint, a longevity project built around his Don’t Die philosophy. On X he shares rigorous self tracking and protocols that aim to measure and improve health, all in pursuit of extending healthy lifespan. Follow him at x.com/bryan_johnson.

His program focuses on data driven nutrition, sleep, and exercise to slow or even reverse markers of biological age. The image above represents the food guide he currently considers best based on his testing and continuous measurement.

Nike unveiled Project Amplify, a powered footwear system built with robotics partner Dephy that adds a lightweight motorized brace to your lower leg. It provides mechanical assistance that feels like an extra set of calf muscles, aiming to make everyday walking and running faster with less effort for regular people rather than elite athletes.

Nike says the target user runs about a ten to twelve minute mile and wants to go farther or get to work a bit quicker without arriving exhausted. The company has tested the system with hundreds of participants, studying energy savings and comfort so the boost feels natural and consistent across different paces and terrains.

A consumer release is planned, and Project Amplify sits alongside other research like neuroscience informed footwear and temperature regulating apparel. For more on the concept and early testing, read the original report at The Verge.

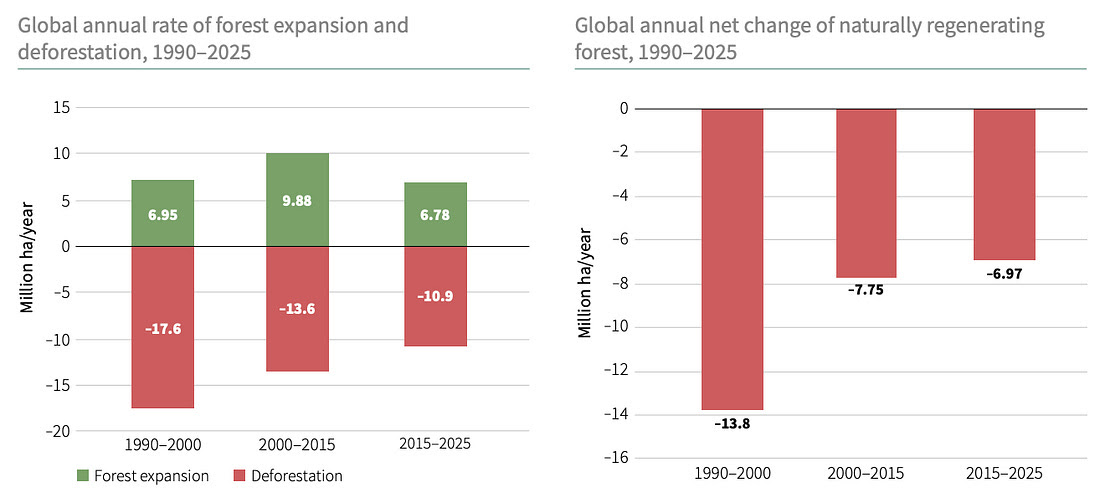

Global deforestation has continued to decline for the third straight decade. Annual forest losses have dropped from 176,000 km² in the 1990s to about 109,000 km² over the past ten years. While roughly 5 million km² of forest have been lost since 1990, protection efforts are gaining ground — one in five forests worldwide are now legally safeguarded. Since 1990, an additional 2.51 million km² have come under protection, signaling a steady global shift toward conservation.

After a century of restrictions on Indigenous burning, California tribes are once again practicing “good fire.” New laws now recognize their sovereignty to carry out cultural burns — small, deliberate fires that rejuvenate native plants, boost biodiversity, and lower the risk of catastrophic wildfires. In northern California, tribal fire practitioners are training new generations to read the land and burn responsibly, weaving traditional wisdom together with modern ecological science to restore balance to the environment.

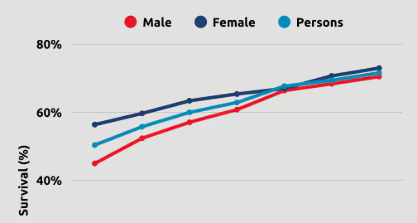

Australia’s five-year survival rate for all cancers has climbed to 71%, up from just 49% in the late 1980s — among the highest in the world. Cancer mortality has dropped 24% since 1990, thanks to earlier detection, widespread screening, and advances in precision treatments. Survival now tops 90% for breast and prostate cancers and 70% for melanoma, marking a remarkable national transformation in cancer care and outcomes.

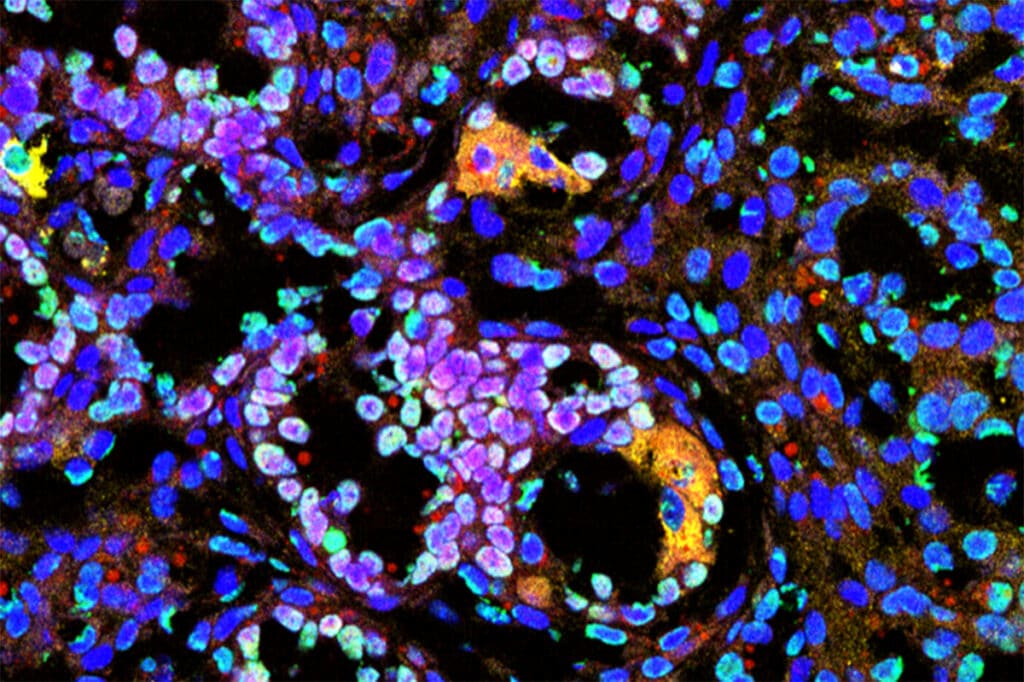

Scientists at the University of Cambridge have successfully grown human blood from stem cells, creating 3D “haematoids” that replicate how embryos naturally form blood. These self-organising structures produce both red and immune cells in the lab, offering new ways to model diseases like leukaemia and potentially generate blood for transplants. Researchers describe it as a major leap toward understanding—and eventually recreating—the process of human blood formation.

The Chinese Academy of Sciences has achieved a new milestone in fusion research by creating a record-breaking superconducting magnet. Operating 700,000 times stronger than Earth’s magnetic field and sustained for half an hour, the magnet opens new frontiers for nuclear fusion experiments. Superconducting magnets allow electricity to flow with almost no resistance, generating the immense magnetic fields needed to contain plasma and advance fusion as a clean energy source.

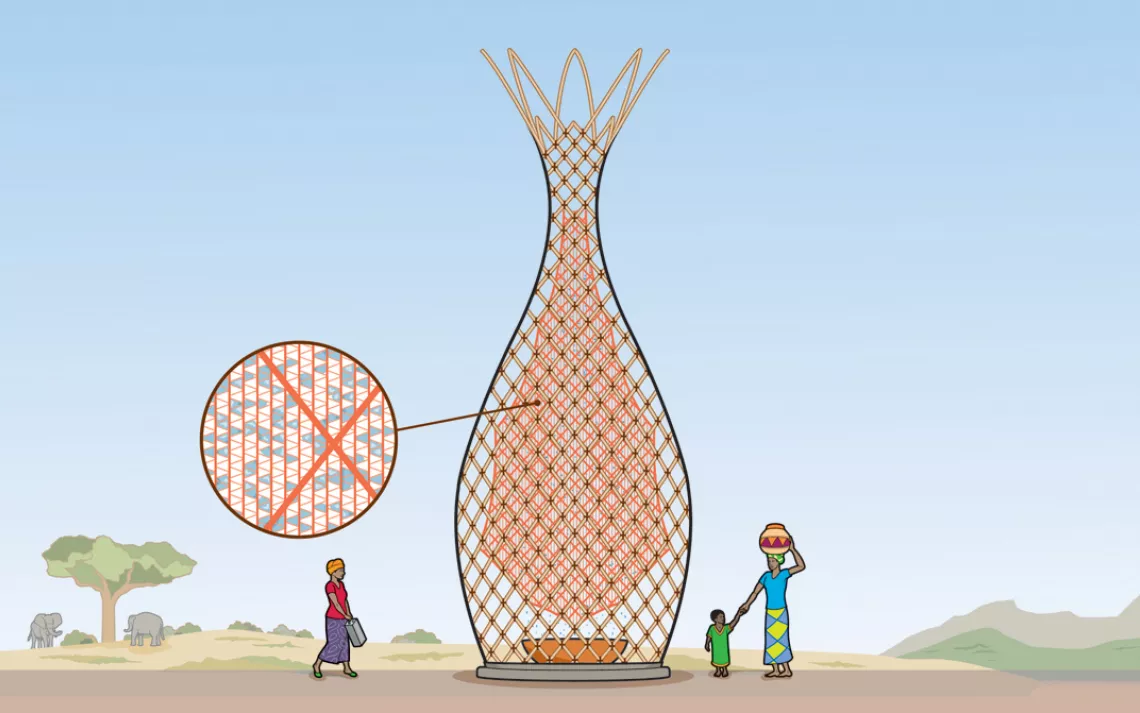

A startup founded by newly minted Nobel laureate Omar Yaghi is turning groundbreaking chemistry into a real-world solution: drawing clean water straight from the air. Set to launch in 2026, its solar-powered “water-from-air” devices can produce up to 1,000 litres per day without electricity. The technology uses metal–organic frameworks to capture moisture from even dry air, offering hope for drought-stricken regions — a powerful example of Nobel-winning science meeting global need.

Enjoying The Hillsberg Report? Share it with friends who might find it valuable!

Haven't signed up for the weekly notification?

Subscribe Now