Quote of the week

“The chains of habit are too light to be felt until they are too heavy to be broken.”

- Samuel Johnson

Edition 42 - October 19, 2025

“The chains of habit are too light to be felt until they are too heavy to be broken.”

- Samuel Johnson

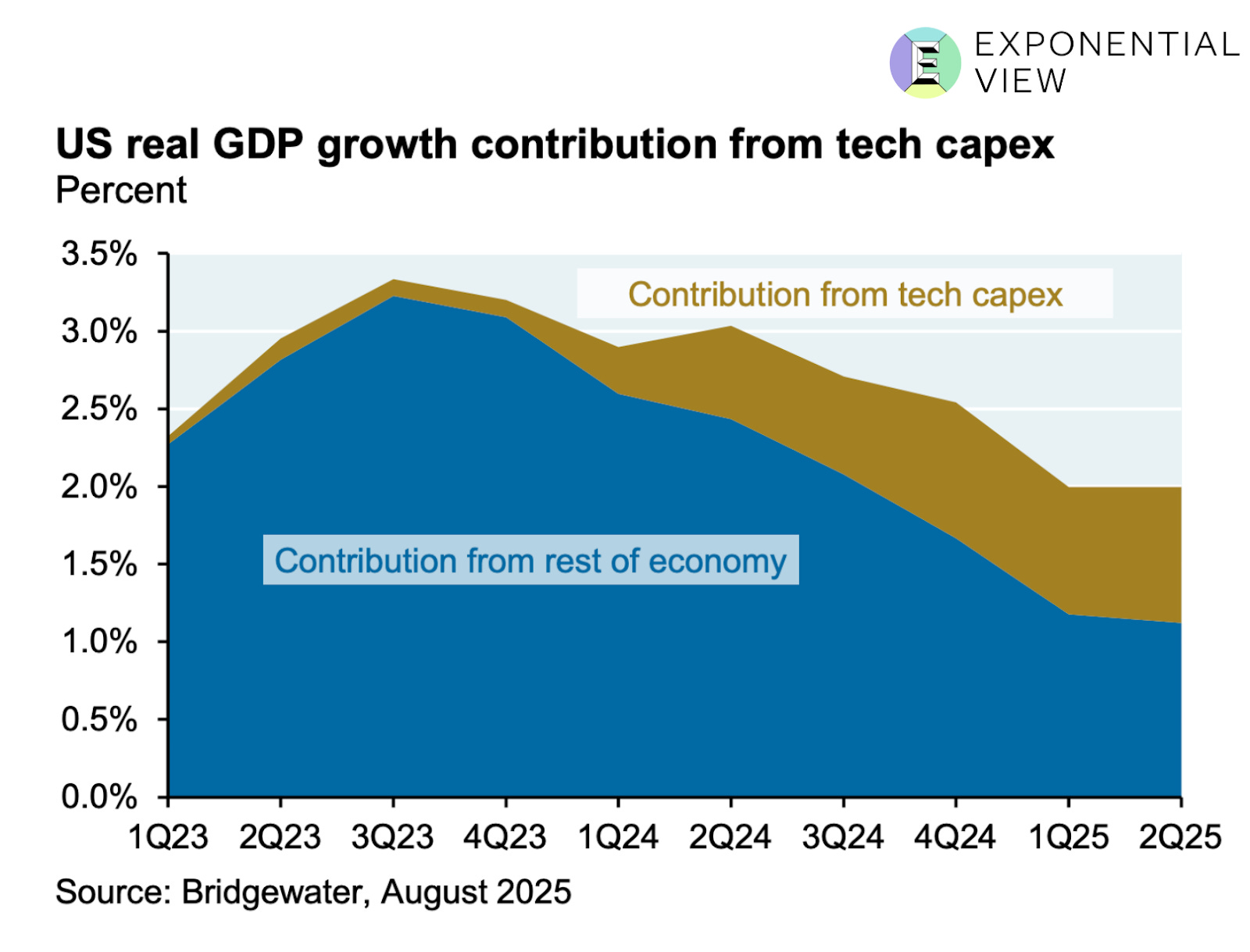

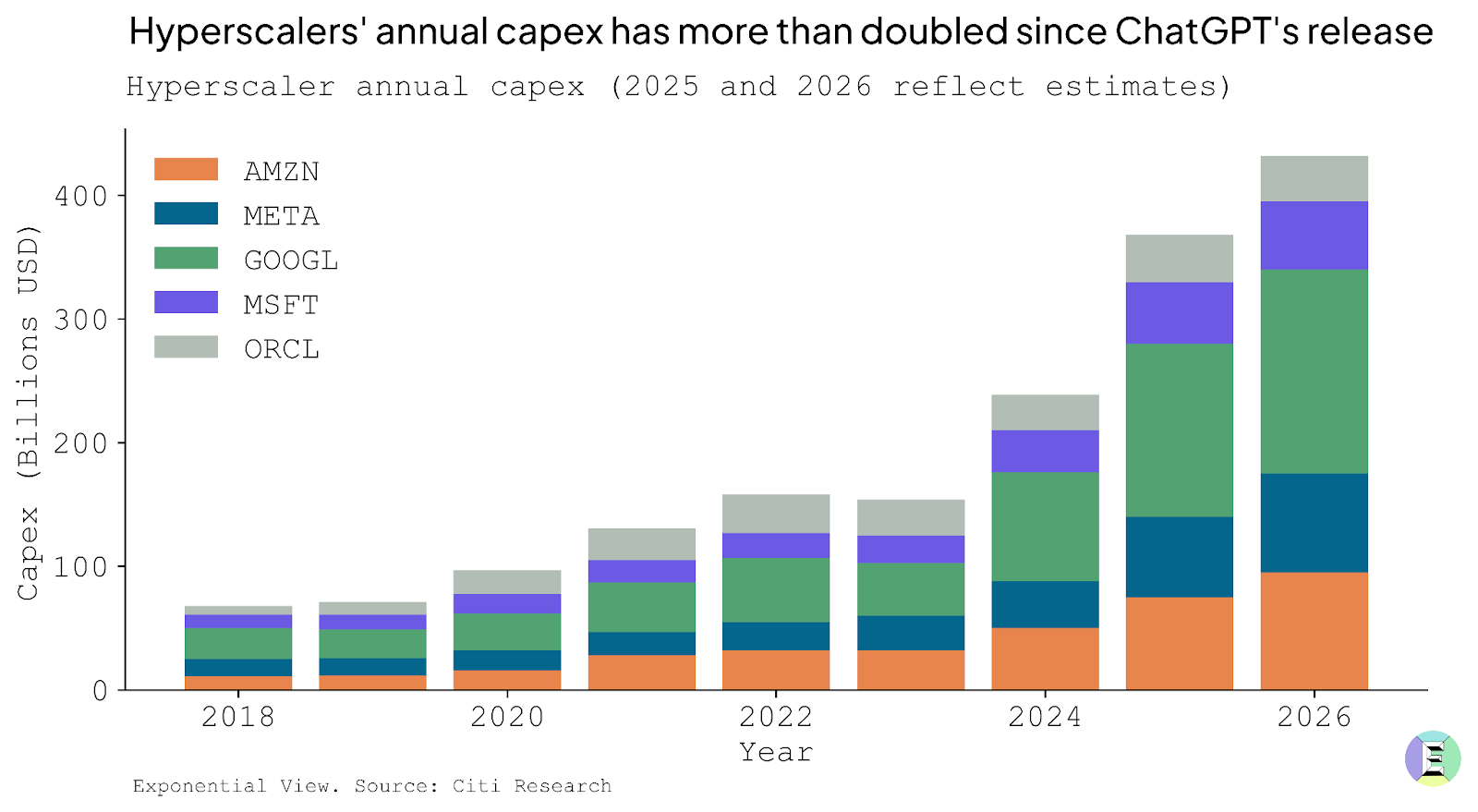

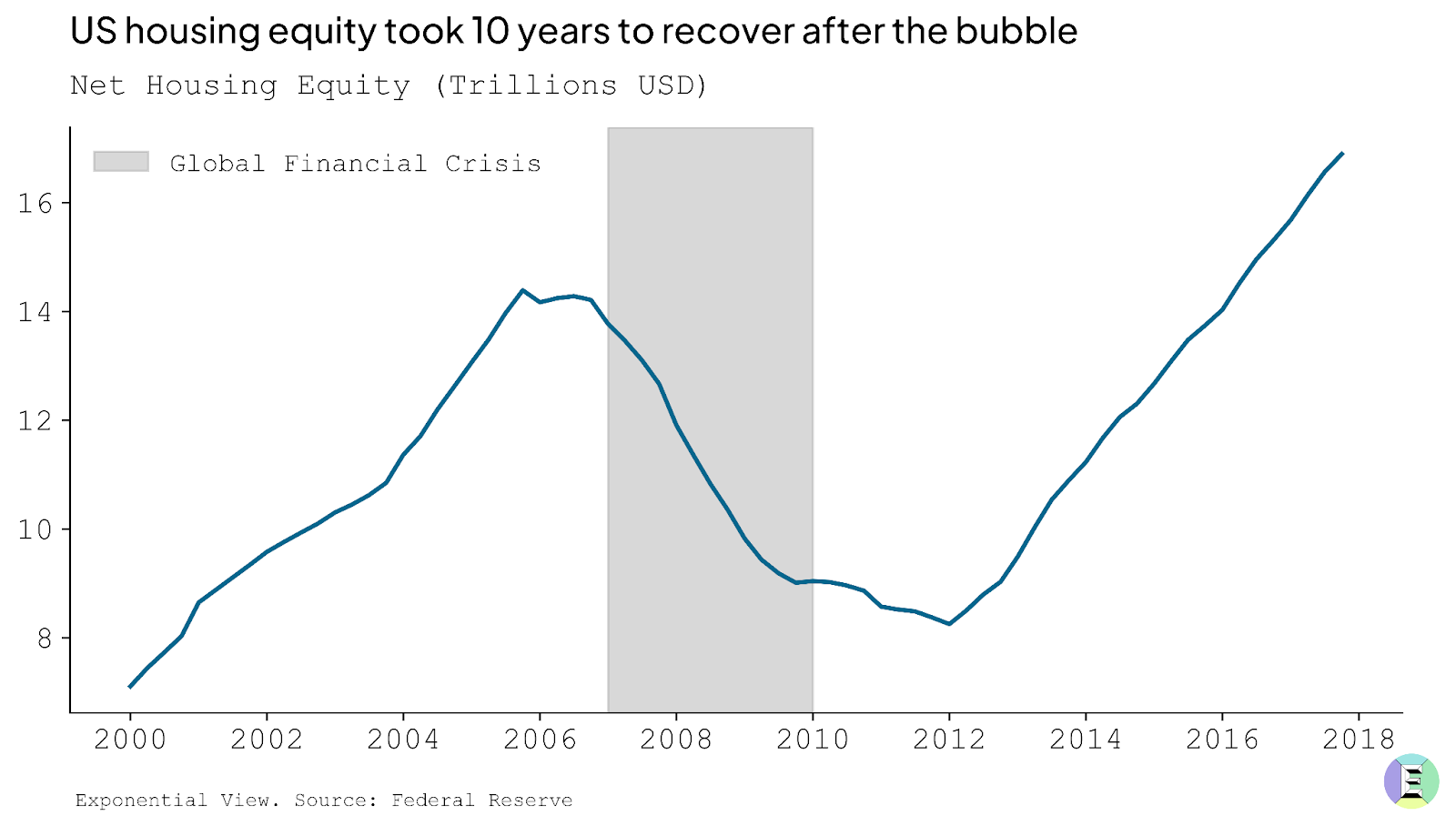

What is a bubble? Economists describe bubbles as recurring stories in capitalism — parables of excess, belief, and collapse that are as much cultural as financial. They trace their lineage from Tulip Mania in 17th-century Holland, often exaggerated but enduring as a moral tale about optimism, through the South Sea Bubble of the 1720s, the roaring 1920s stock boom, Japan’s 1980s real estate frenzy, and the 2008 housing crash. Technology has its own versions too: the 1840s railway boom, 1990s telecom overbuild, and the dot-com era, each driven by faith in transformative infrastructure that overshot real demand. In formal terms, a bubble is a phase where prices and investment surge far beyond fundamentals, often marked by a 50 percent drawdown in equity values sustained for at least five years and a collapse in productive investment. Bubbles thrive on abundant capital and seductive narratives, ending in a sharp, enduring reversal that wipes out much of the paper wealth accumulated on the way up. So when you look at the following two images, you find yourself wondering if we're in one right now.

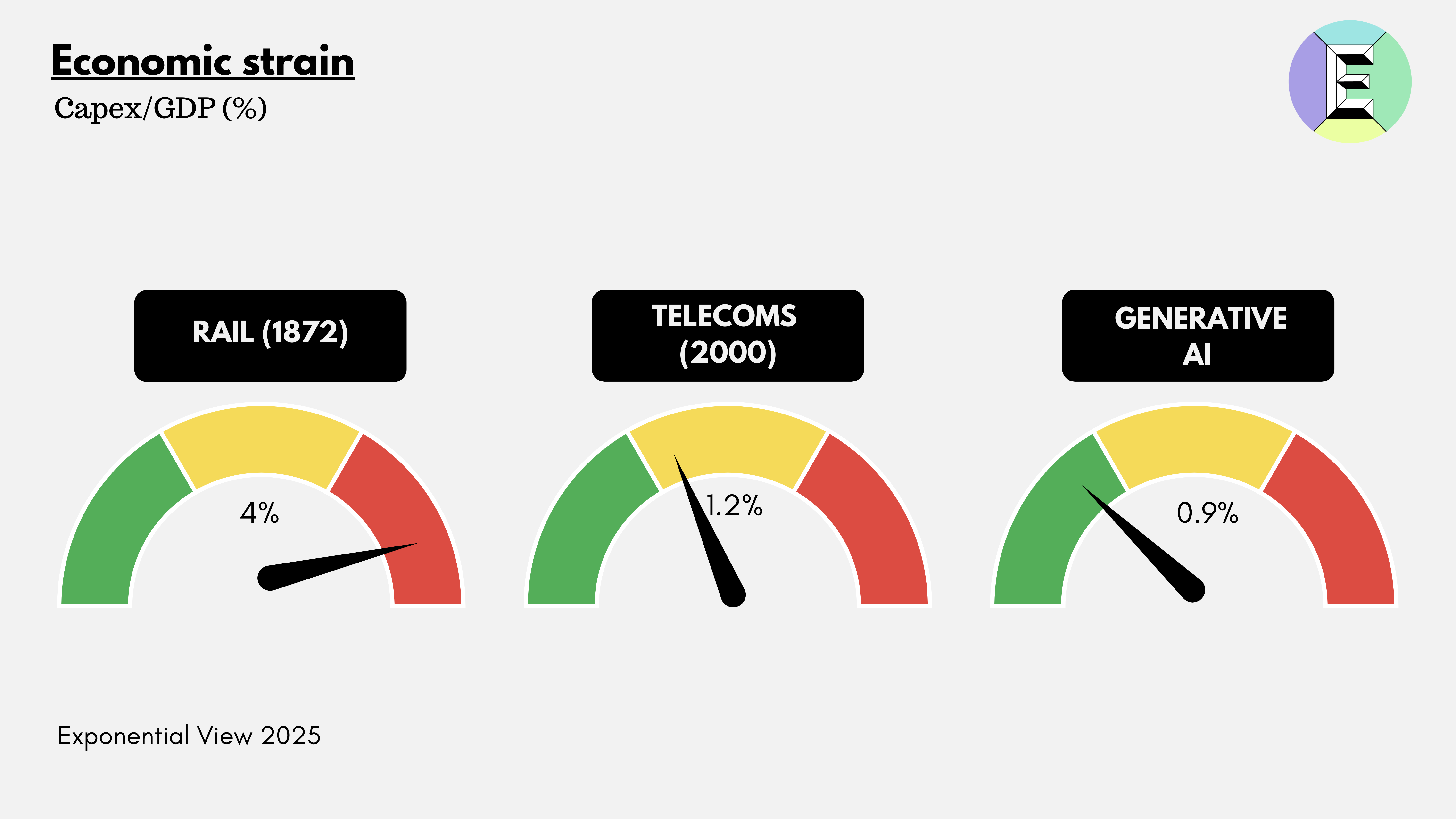

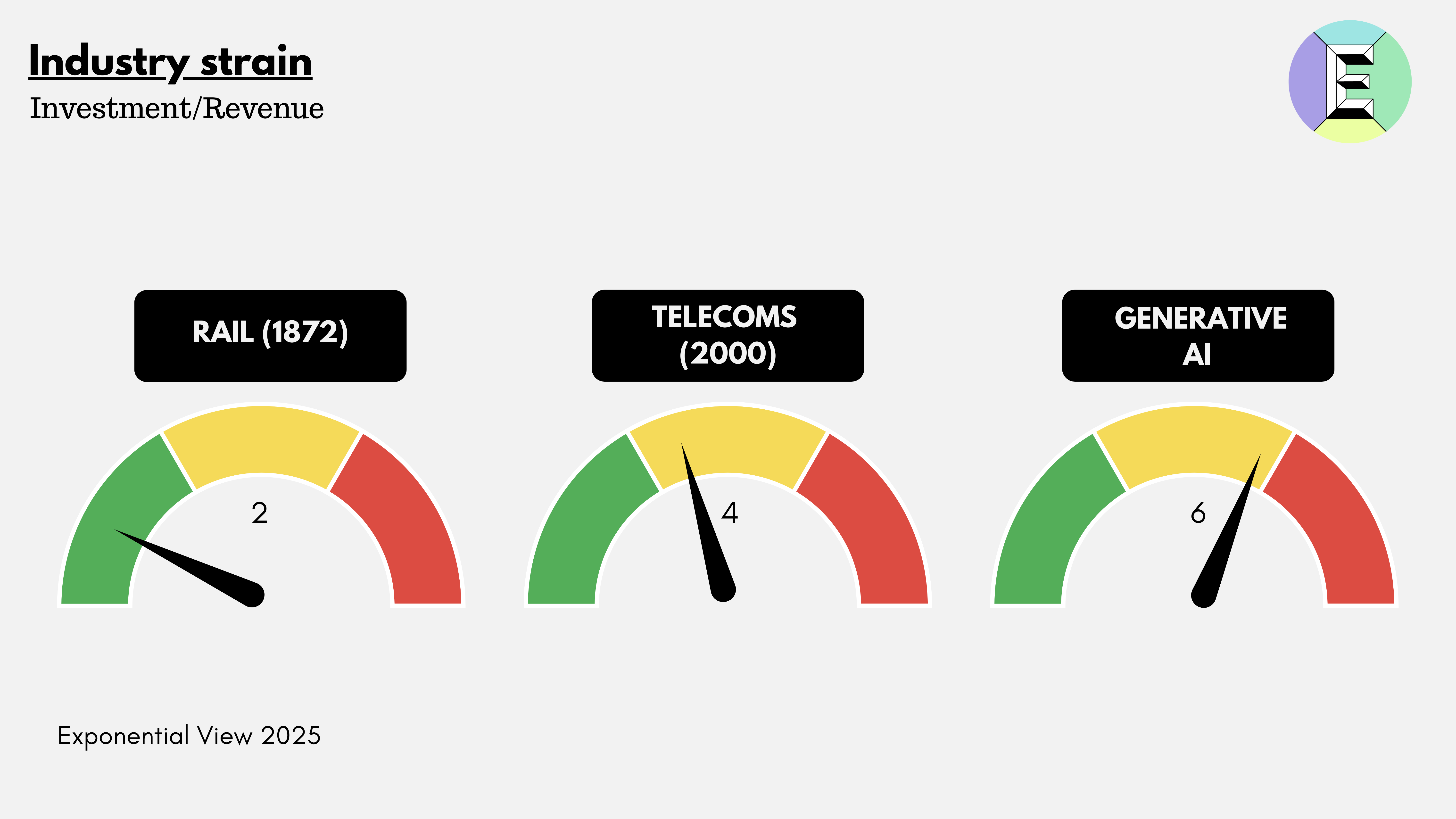

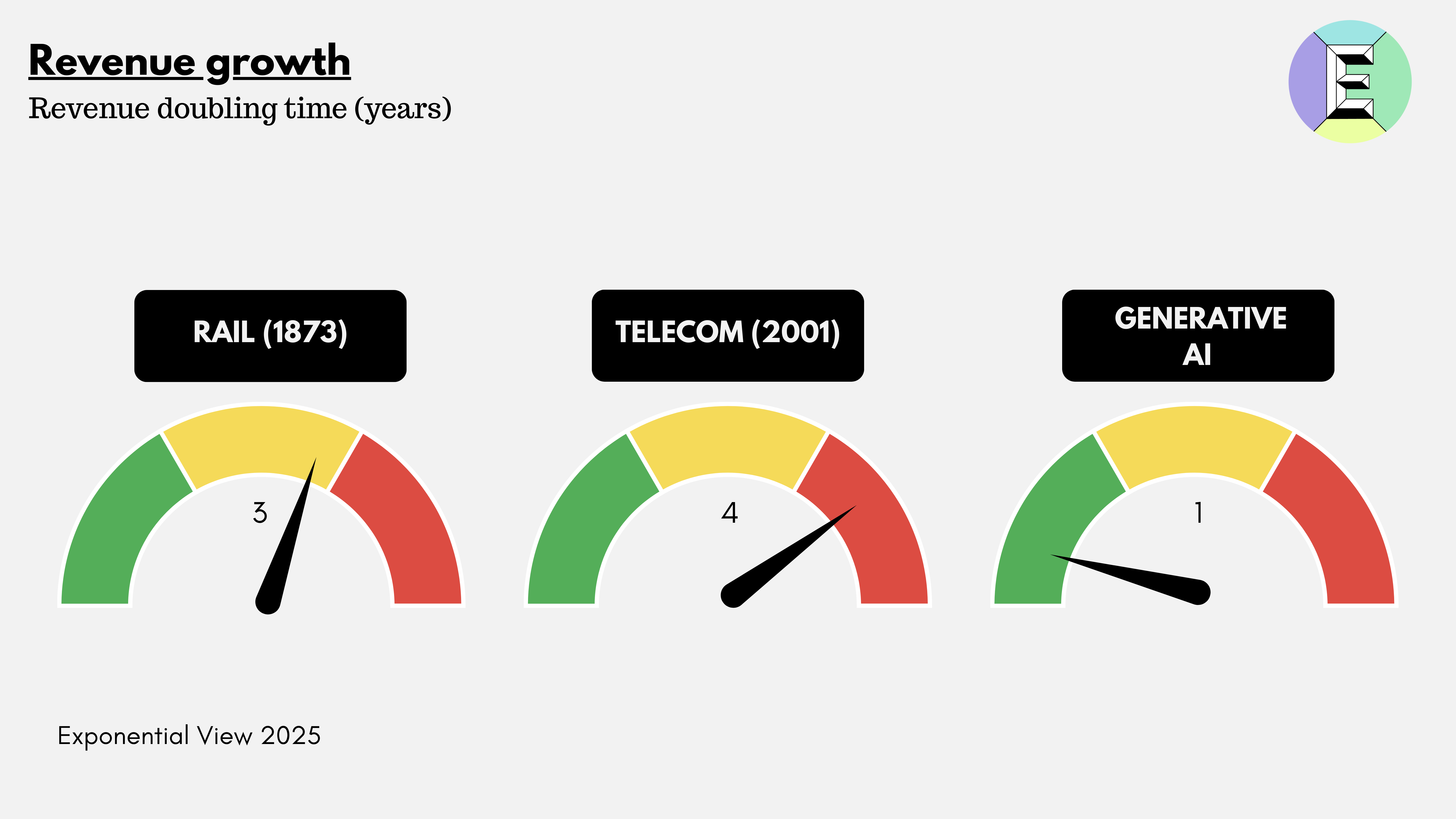

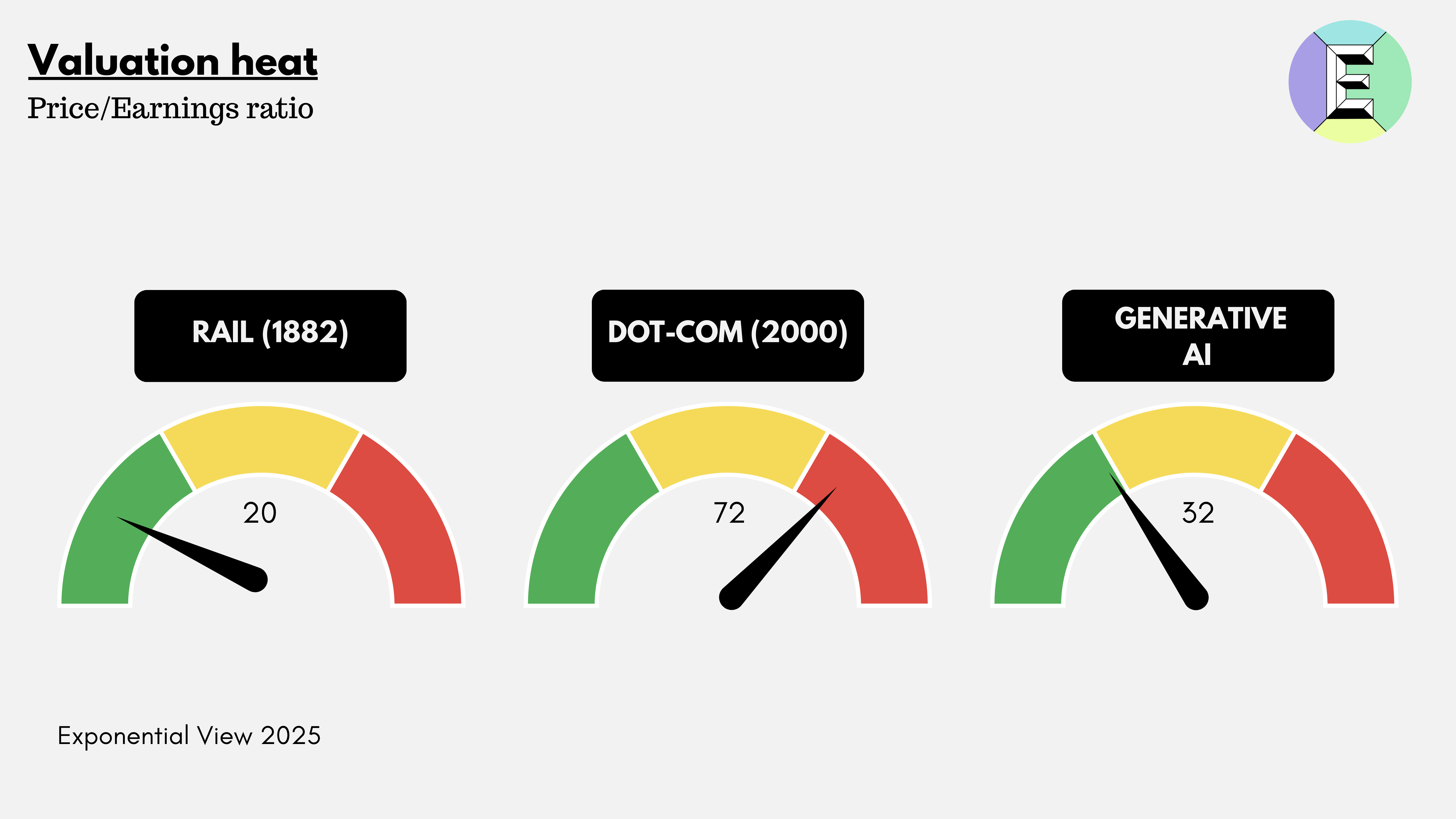

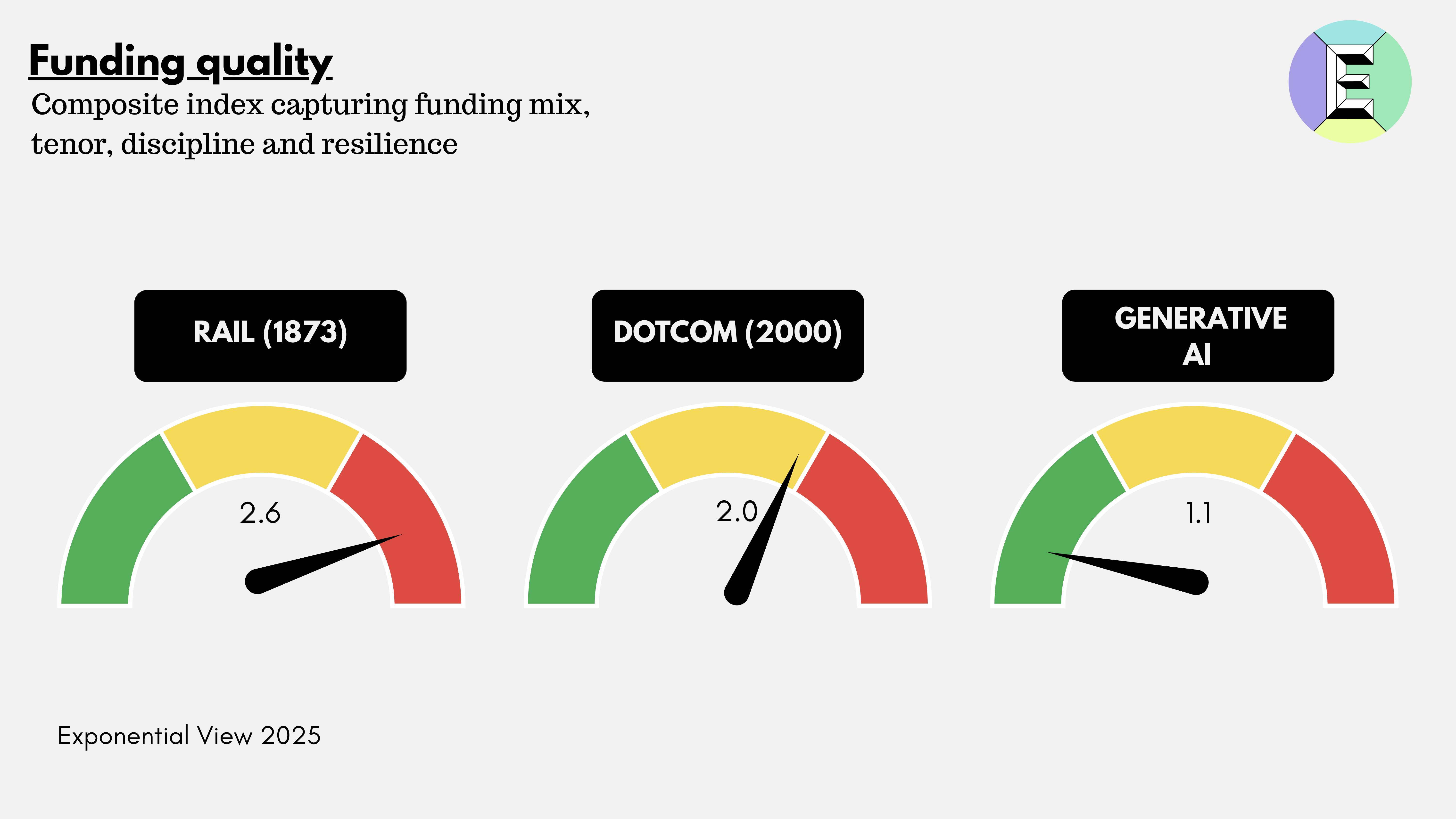

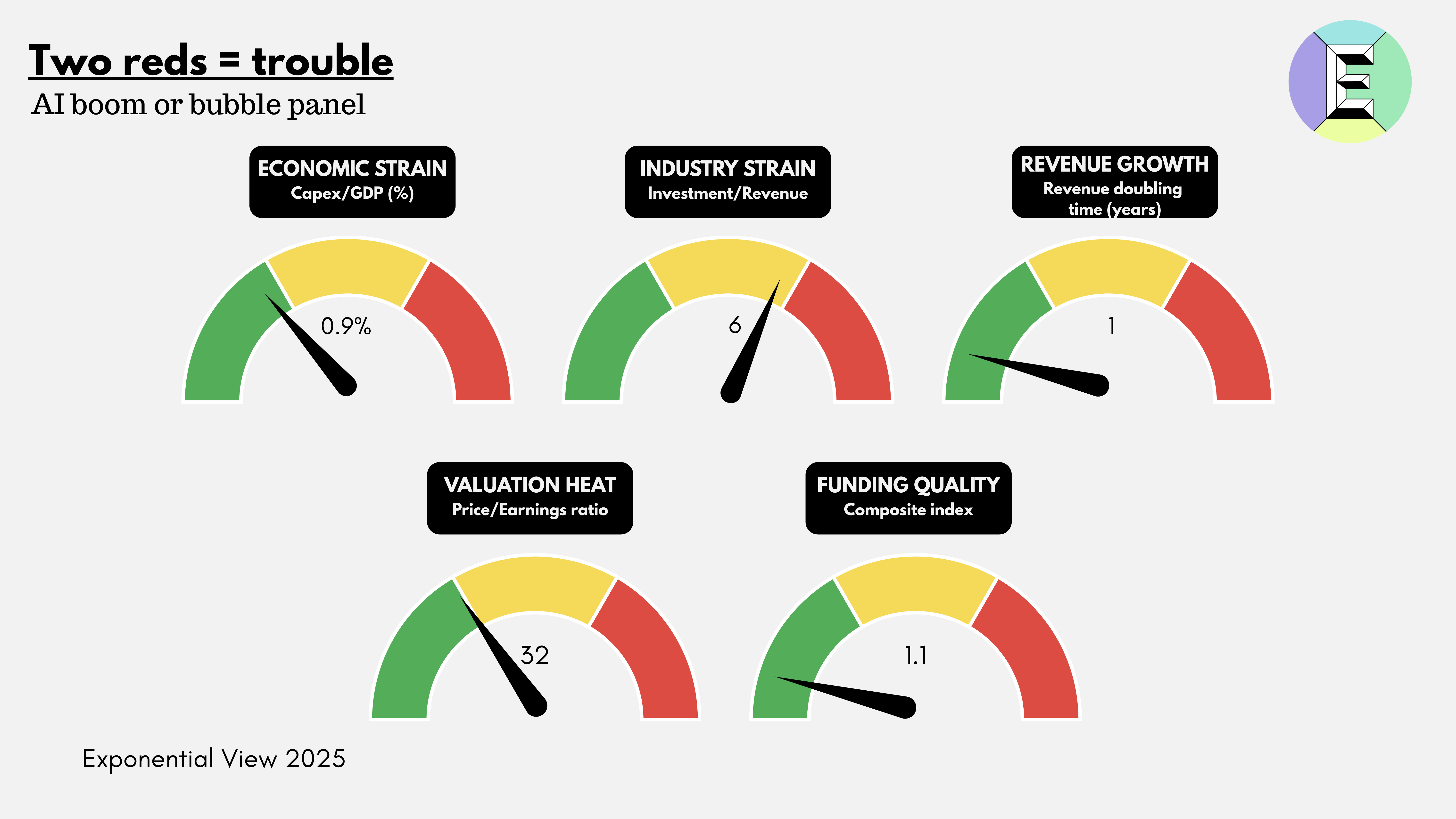

In this Exponential View analysis, the author uses five gauges to test whether AI is entering bubble territory. Each gauge captures a different aspect of financial, industrial, or structural stress within the system.

Overall, the authors’ verdict is “boom,” not (yet) “bubble.” Demand looks real, valuations aren’t crazy, and while capital intensity and financing structures bear watching, the system remains grounded. Their rule of thumb: if two of the five gauges turn red, you’re in bubble territory. Personally, I agree - we’re not there yet. AI’s current wave feels more like the early buildout of real infrastructure than speculative mania. I see usage limits as a leading indicator of the vast demand. The one thing I do worry about and wrote about in the previous newsletter is the amount of CapEx going towards technologies that are still rapidly improving and infrastructure build out that won't be a future fixed cost - GPUs will need to be replaced at most every few years for the foreseeable future.

Still, there are tripwires to watch. Economic strain would emerge if AI CapEx exceeds 2 percent of GDP, signaling overinvestment relative to productivity gains. Industry strain would show up if revenue per dollar of capex fails to reach at least 0.5 to 1.0, meaning scale isn’t producing efficiencies. A slowdown in enterprise or consumer AI spending — say, NVIDIA’s backlog shrinking — would be a red flag. Valuations jumping toward 50–60 P/Es would look frothy, and funding quality would deteriorate if internal cash covers less than 25 percent of CapEx, forcing reliance on debt backed by fast-depreciating GPUs.

Bottom line: today’s AI surge resembles past “installation” phases — massive buildout, real usage growth, and valuations that are elevated but not absurd. The critical hinge will be whether revenues keep compounding fast enough to close the CapEx gap before depreciation and complex financing structures start to bite. Not a bubble yet, but the pressure points are clear and worth watching closely.

Spotify and Netflix are teaming up to challenge YouTube in the fast growing video podcast space. Both companies see that YouTube has become the default home for podcasts and creator style video, and neither can win that battle alone. For Spotify, this is a second swing at video after exclusives delivered mixed results. For Netflix, it is a path to broaden beyond big budget shows into lower cost, wide appeal formats that lift engagement and feed an ads business that needs steady inventory.

Under the deal, full episodes live inside Netflix, while only short clips appear on YouTube, which is a clear bid to pull audiences into their shared ecosystem. The move points toward bundled entertainment that blends music, video, and podcasts under one roof, similar to Apple and Amazon, and it highlights how control over distribution still decides winners in streaming. By deciding where and how shows travel, the pair hopes to carve out a defensible lane against YouTube. Apple may have pioneered podcasts, but in this slice of the market it now looks like a distant player.

Great, so what happens next? YouTube’s strength comes from user supplied content with almost no inventory risk. Netflix is the opposite, it must buy or produce nearly everything, and very little of it can be low quality. If Netflix wants to push beyond podcasts, it needs a way to let the crowd bring ideas without drowning the service in junk. That suggests a new layer in the product, a runway where creators can submit video podcasts and adjacent formats like talk shows, debates, documentaries, comedy bits, and even more professional films with controlled exposure and strict quality bars before anything gets wide placement.

Imagine a content funnel. Step one is an open submission portal with templates for pitches and 10–20 minute pilots, along with a rights checklist and brand-safety attestation. Submissions automatically pass through machine filters that check for audio clarity, basic editing, hate or harm flags, and duplicates. Step two is a human review team that combines three roles: editorial scouts who judge story and host quality, trust and safety specialists who evaluate brand risk and compliance, and data reviewers who run small audience tests with 5,000–20,000 viewers in a separate test tab. Step three is a pilot shelf where top-scoring entries earn a small budget — typically $25,000 to $75,000 — to reshoot or extend their pilot, with Netflix or Spotify studios offering light production support. Step four is a limited regional release with clear performance gates, such as a 50%+ completion rate for a 20-minute episode, satisfaction scores, and watch hours per viewer. Shows that meet these targets advance to a full season order within the podcasts and talk hub.

Creators receive a minimum guarantee to cover pilot costs and a revenue share based on ad performance and engagement. The engagement pool could distribute funds based on watch hours, with bonuses for driving new subscribers or reducing churn. Creators keep their underlying IP where possible but grant Netflix exclusivity on full episodes for a set window, while Spotify owns the audio version. This gives creators meaningful upside, offers Netflix predictable quality, and maintains transparent standards. The team would resemble a small venture-style slate group — one lead, several genre editors, trust and safety specialists, rights and clearance lawyers, data scientists for test design, and a creator relations crew for onboarding and workshops. Supporting tools would include a submission CMS, a red-flag dashboard, and a test shelf that can promote content to a small audience without leaking into the main algorithm.

Does it make financial sense? Traditional Netflix series can cost millions per hour to produce. This funnel aims to keep pilot costs below $100,000 and full-season costs under $500,000 for talk or documentary-style shows. With an ad CPM between $12 and $20 and two to three ads per 20-minute episode, a consistent performer with 3 million qualified starts could generate hundreds of thousands in ad revenue per season, even before factoring in subscription effects. The real impact is in retention and acquisition: if a slate of these shows improves monthly retention by just 0.1%, the additional lifetime value could justify a content budget in the tens of millions. Success thresholds should be clear — greenlight shows with a completion rate above 45%, return rate above 30% within 14 days, cost per hour watched under 25 cents, and ad yield covering at least 1.5 times production cost, or strong subscriber growth per thousand views. Cancel quickly if safety or accuracy issues arise, or if satisfaction scores fall below 4 out of 7 after two episodes. This approach can work, but only if Netflix avoids flooding the main feed with low-quality pilots. Keep the funnel, keep the gates, and let the best shows rise. If done well, the partnership turns Spotify into a discovery engine for new voices and Netflix into the finishing school—creating a pipeline from clip to pilot to season that can finally compete with YouTube’s breadth without inheriting its chaos.

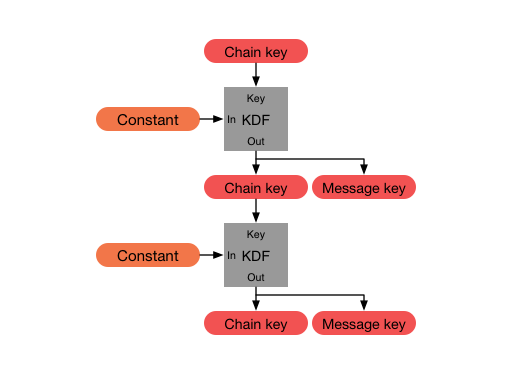

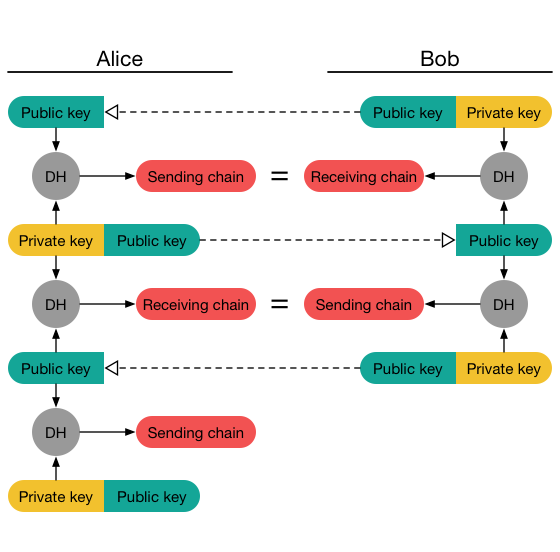

This week Signal announced a major upgrade to its encryption protocol: the introduction of the Sparse Post Quantum Ratchet (SPQR). This new layer sits atop the existing “Double Ratchet” system to form what Signal calls the “Triple Ratchet.” The goal is simple but bold: make Signal not just safe against today’s threats, but ready for a future where quantum computers could break current encryption.

The change builds on earlier work. Signal had already added a hybrid handshake called PQXDH, which combines classical and post-quantum key exchanges. That step protected users from the “harvest now, decrypt later” threat — where adversaries store encrypted data today, planning to decrypt it once quantum tech matures. SPQR takes this further by securing the ongoing “ratcheting” process that constantly updates chat keys during a conversation. This means that even as you text back and forth, your messages are protected by both classical and post-quantum cryptography.

In simpler terms, the ratchet system is what keeps your past and future messages safe, even if something goes wrong in the present. Each time you send or receive a message, new encryption keys are generated while old ones are discarded. The SPQR adds a third layer that uses a post-quantum Key Encapsulation Mechanism (KEM), likely something like CRYSTALS-Kyber, to produce keys that even a quantum computer would struggle to crack. Signal engineers had to solve the tricky problem of larger key sizes — which could have bogged down mobile messaging — by using chunking and erasure codes that split and reassemble large blobs efficiently. All of this happens invisibly: users don’t have to turn anything on or notice any slowdown.

Looking ahead, Signal’s move sets a precedent. Even though quantum computers capable of breaking modern encryption don’t yet exist, this upgrade sends a message that being proactive about future security isn’t optional. Other platforms — from WhatsApp to iMessage — will likely face pressure to follow. Expect more hybrid post-quantum protocols over the next few years as engineers redesign key exchange and encryption layers to stay ahead of the curve. For now, this is more about future-proofing than responding to an active threat, but it also signals a shift: post-quantum cryptography has officially moved from academic theory into real, everyday apps.

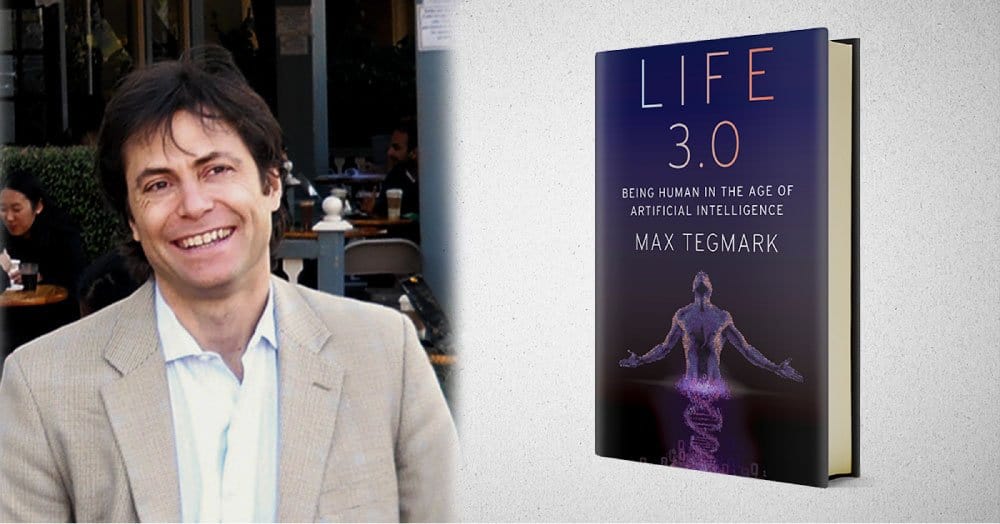

I recently finished reading Life 3.0 by Max Tegmark and found it to be very thought provoking. At the end of the book Max talks about the Future of Life Institute he helped to found and the Asilomar AI Principles.

The Asilomar AI Principles are a set of principles defined by a large group of leading AI minds at The Asilomar Conference to help safely shape the future of AI. At the conference, the organizers reviewed reports on the opportunities and threats created by AI and compiled a long list of the diverse views held on how the technology should be managed. They then attempted to distill this list into a set of principles by identifying areas of overlap and potential simplification. Before the conference, attendees were surveyed extensively, gathering suggestions for improvements and additional principles. These responses were folded into a significantly revised list for use at the meeting.

In Asilomar, the group gathered further feedback in two stages. To begin with, small breakout groups discussed the principles and produced detailed feedback. This process generated several new principles, improved versions of the existing ones, and, in several cases, multiple competing versions of a single principle. Finally, a full survey of attendees determined the level of support for each version of each principle.

The final list consisted of 23 principles, each of which received support from at least 90% of the conference participants. They can be found here along with other wonderful resources.

Research Issues

Ethics and Values

Longer-term Issues

I signed my name to uphold these principles and encourage others to review them, think for yourself, and do the same.

UNICEF says about 10 million fewer children in Eastern Europe and Central Asia are living in poverty compared to 2021, with Armenia, Georgia, and Uzbekistan leading the improvements due to stronger social programs and higher wages.

Once nearly extinct, green sea turtles are rebounding in the Pacific. Nest counts on Australia’s Heron Island have increased tenfold since the 1970s, and populations across the region now meet IUCN recovery benchmarks—thanks to years of protection, turtle-safe fishing practices, and community-driven conservation.

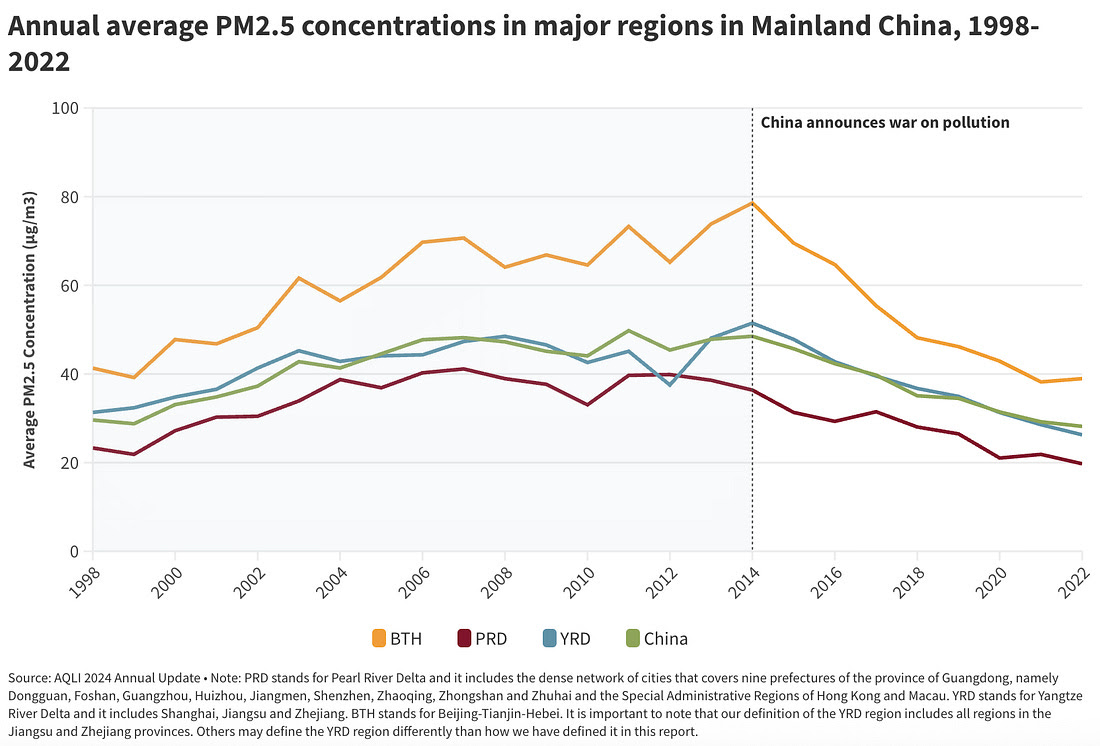

China’s clean-air campaign has added years to citizens’ lives. Since 2013, air-quality reforms have cut fine particulate pollution by nearly half, preventing an estimated 2.2 million premature deaths each year. According to the University of Chicago, the average lifespan has increased by 2.9 years — gains comparable to those from decades of U.S. environmental policy, achieved in only ten years.

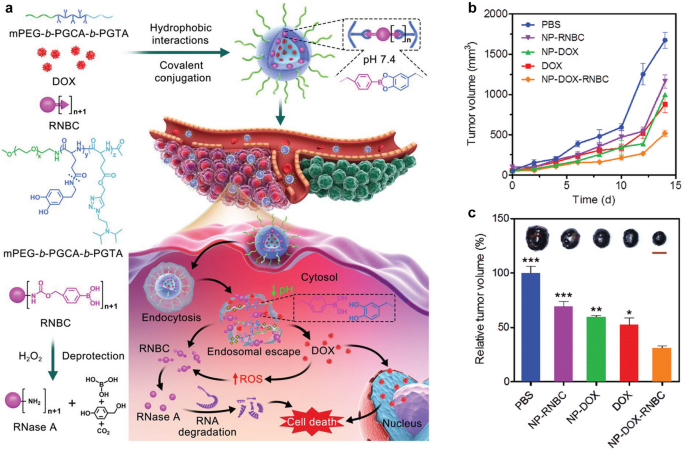

Two promising cancer treatments are on the horizon. Scientists have created a therapy that uses natural enzymes to weaken cancer cell membranes, making tumors more susceptible to the body’s immune system. The approach “softens” cancer cells without damaging healthy tissue and could boost the effectiveness of immunotherapy and chemotherapy.

Helion has received approval to begin the next stage of its commercial fusion power plant. The Conditional Use Permit allows construction of the fusion generator building for its Orion facility in Malaga, Washington. Helion aims to deliver electricity to the grid before the decade’s end. Through rapid iteration and testing, the company has steadily advanced toward viable fusion power—becoming the first private firm to reach 100 million degrees Celsius, the benchmark for commercial fusion feasibility

Enjoying The Hillsberg Report? Share it with friends who might find it valuable!

Haven't signed up for the weekly notification?

Subscribe Now