Quote of the week

“Courage is grace under pressure.”

- Ernest Hemingway

Edition 41 - October 12, 2025

“Courage is grace under pressure.”

- Ernest Hemingway

OpenAI’s October 6th DevDay wasn’t about a single new model or jaw-dropping demo, it was about turning ChatGPT into a platform. The company unveiled “apps” inside ChatGPT from partners like Spotify, Canva, Zillow, Expedia, and Figma. Think of it as a mini web inside the chat, where you can book a flight, design a poster, or browse homes without ever leaving the conversation. These companies might lose some web traffic, but the trade-off is exposure to hundreds of millions of weekly users. OpenAI also teased an Apps SDK that lets developers connect data, trigger actions, build interactive UIs, and even monetize directly inside ChatGPT. It’s all built on their new MCP system and you can read the full rundown in the official DevDay recap.

If that sounds like OpenAI is building an everything app, you’re right. They’re not just trying to dominate AI chat, they’re trying to absorb the web. The catch? Developer apps aren’t open to the public yet; OpenAI is hand-picking partners for now. But once it scales, it could redefine how people interact with software altogether. It’s a bold bet that conversation can become the new interface. What’s unclear is how much of the heavy lifting OpenAI is doing for partners versus expecting developers to build full experiences themselves. Either way, it’s a major move toward centralizing the internet under a single chat window.

Beyond apps, OpenAI announced a flood of new tools for developers — AgentKit, ChatKit, Widget Studio, and more — essentially a toolkit for creating “agentic” workflows that can act, reason, and run autonomously. AgentKit directly competes with automation platforms like Zapier, Make, and n8n, but instead of replacing them, it might expand the whole category. The new AgentsSDK even lets developers test locally and deploy directly. There’s also a Connector Registry for linking agents to external services, which could become the plumbing layer for the next generation of AI apps. Developers can also bring chat into their own products with ChatKit, which lets you fully brand and integrate OpenAI chat capabilities into your own app.

Then came the model announcements: GPT-5-Pro for the API, Sora 2 for video generation, and a realtime mini voice model that makes ChatGPT feel almost alive. Codex is back too, powered by a new GPT-5-Codex model with enterprise controls and a slick Slack integration. The demo was quite impressive. The bigger takeaway from DevDay wasn’t just smarter models, but OpenAI’s steady shift from product to platform. The company doesn’t just want to be where you chat, it wants to be where the internet lives. As I've mentioned before, I wonder if this is an attempt to build out an additional revenue stream due to investment pressures and/or if they are expanding to this layer due to the slowdown in their race toward "ASI."

For those who want to dive deeper, OpenAI has posted a series of helpful breakdowns and demos on their YouTube channel.

I have talked before about the future of decentralized finance, where markets are rebuilt by blockchain and crypto tools that let value move without middlemen. A fresh twist may accelerate it.

Polymarket, a crypto prediction market where people trade on real world outcomes, just drew a major investment from the New York Stock Exchange’s parent company, Intercontinental Exchange, which said it will invest up to $2 billion. Separately, Polymarket acquired the US regulated exchange and clearinghouse QCX for $112 million, a step toward operating for US users within a compliant framework. That combination signals a potential expansion into the US market, following earlier CFTC constraints and a planned return.

Think about every business. Movie studios greenlight films. Real estate developers put shovels in the ground. Small business owners sign leases. These are all big bets with real odds of limited or negative return. If liquid prediction markets opened up at scale, pricing outcomes in real time, many of those risks could become hedgeable and therefore more predictable. Maybe even investable for larger volumes of lower-income people.

That would look like reinsurance and angel investing on steroids, where uncertainty itself becomes a portfolio. I do not know if it will play out that way. Liquidity, clean event definitions, trustworthy oracles, and regulation are tall hurdles. But if platforms like Polymarket keep moving into regulated lanes, the idea of hedging almost anything stops sounding like science fiction and starts sounding like market structure.

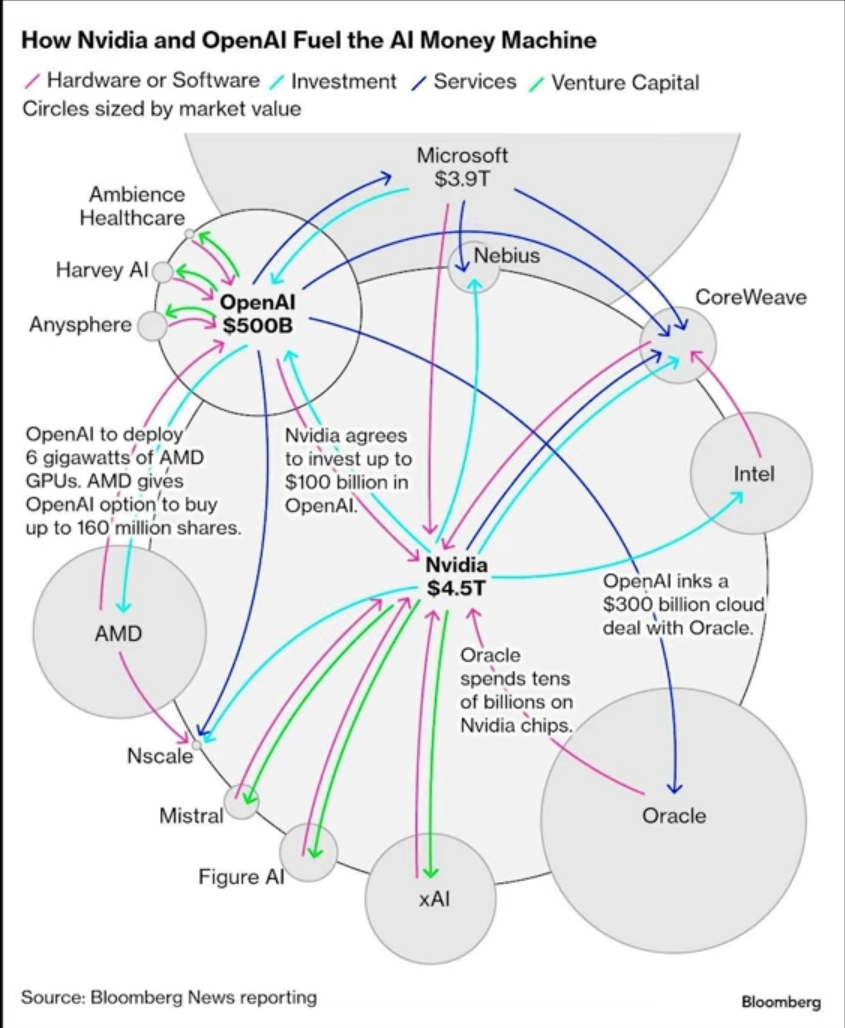

That chart captures how tightly today’s AI leaders are linked. Nvidia, OpenAI, Microsoft, AMD, Oracle, and others are wiring together investments, chip purchases, and cloud commitments that depend on one another.

The headlines tell the story: Nvidia plans to invest up to $100 billion in OpenAI to back new data centers. OpenAI signed a $300 billion multi-year cloud deal with Oracle. AMD will supply up to 6 gigawatts of GPUs and granted OpenAI a warrant for as many as 160 million AMD shares tied to milestones.

Bloomberg calls this the AI money machine, a circular loop where capital funds compute, compute powers models, and success attracts more capital. It is powerful, but it also concentrates risk if any link weakens.

My take: future breakthroughs in software or hardware could slash compute needs and turn parts of this buildout into stranded assets. That risk is not getting enough airtime. We should pace capacity with proven demand and evolve deliberately, which is the opposite of today’s sprint.

There is a fantastic new paper on AI’s economic impact that captures where we are right now with uncanny precision. The author uses a simple metaphor to describe where we are in regards to the relationship between AI and the economy: we are driving in fog. It’s possible we have miles of open road, and it’s possible we’re about to hit a tree. The argument is that the uncertainty around AI’s effects on productivity, wages, and growth is not a failure of analysis but a reflection of how little precedent we have for technology this powerful.

Economists have spent the past two years trying to measure the early signals. Some data points suggest AI could drive a boom in efficiency and new business formation. Others hint at labor disruption and deflationary pressure as software automates more work than expected. The paper’s value lies in its humility — it doesn’t try to predict a single outcome but instead sketches a range of plausible futures. In that sense, it feels less like a forecast and more like a survival guide.

The sensible takeaway is preparation, not prediction. If we are indeed driving in fog, then good policy and good business strategy both come down to readiness. That means investing in skills, flexibility, and safety systems that can handle either direction the road takes us. AI’s trajectory might be exponential, or it might plateau, but either way, keeping our hands steady on the wheel is the smartest move.

Science Corp., a California-based company, has engineered a new protein that could one day help restore sight to people who are blind. The protein, called opsin, generates electrical currents when exposed to light. Normally, these proteins need intense light sources to work, but Science’s researchers have created a version that functions under normal indoor lighting. The company is developing both a vision-restoring implant and a brain chip that uses living neurons instead of wires, and this new opsin could be the breakthrough that ties both projects together.

Another promising development comes from a cancer therapy called histotripsy, which uses focused ultrasound bursts to destroy tumors. The rapid pulses create microscopic bubbles that expand and collapse, shredding tumor tissue while sparing nearby healthy cells. The immune system then clears out the remains. The treatment is non-invasive, non-toxic, and typically finished within a few hours, allowing patients to go home the same day. The U.S. FDA has now approved histotripsy for treating liver tumors, marking a major step forward in cancer care.

The World Health Organization has confirmed that the entire Western Pacific region is now free of measles and rubella. Every Pacific Island country has eliminated both diseases, and Japan has eliminated rubella. This milestone follows two decades of coordinated vaccination campaigns, high immunization rates, and strong regional surveillance, making the Western Pacific the first WHO region to fully eliminate rubella — a public health triumph years in the making.

And in robotics news, Google DeepMind has introduced RoboBallet, a system that allows factory robots to move together without colliding. The software coordinates multiple machines at once, cutting what used to be days of manual programming down to seconds. Tested successfully on real robot arms, RoboBallet could make industrial floors faster, safer, and more efficient — a kind of mechanical choreography that turns automation into art.

Enjoying The Hillsberg Report? Share it with friends who might find it valuable!

Haven't signed up for the weekly notification?

Subscribe Now