Quote of the week

“You become what you give your attention to.”

- Epictetus

Edition 35 - August 31, 2025

“You become what you give your attention to.”

- Epictetus

Recently, the US government became Intel’s largest shareholder by acquiring roughly a 10 percent ownership stake in the company. This was not achieved through a new cash outlay but by converting billions of dollars in previously allocated CHIPS Act grants and Secure Enclave funding into equity. The arrangement even allows the government to increase its stake if Intel’s foundry unit falls below majority ownership. While this secures Intel’s future as a domestic chip leader, it has also raised concerns that the intervention could harm its reputation, complicate export relationships, expose it to legal risks, and dilute existing shareholders.

The CHIPS and Science Act was originally designed to strengthen US semiconductor manufacturing by distributing loans and grants to companies like Intel. The support was intended to increase capacity and spur innovation without the government holding equity. Under this new agreement, however, unpaid grants and funding were instead converted into ownership. This marks a shift in how government support is structured. Taxpayer dollars are no longer simple aid but a direct stake. Commentators like Chamath Palihapitiya and David Sachs have argued on the most recent episode of the All-In Podcast that if capital is being given away, the government should be getting something meaningful in return, like equity, rather than offering high risk, low return arrangements. That mindset has clearly influenced how the CHIPS Act is being implemented today.

The deeper question is whether government ownership of individual company stock is a good idea. I explored this recently in my article The Theory of Misaligned Incentives. Even if the government holds non voting shares, the presence of ownership introduces a conflict of interest. If a company it owns runs into trouble, there may be political or economic pressure for the government to step in and protect its investment. This starts to look like central government control. In China, the Communist Party exerts control through so called “golden shares” that give them special powers in private companies, enabling them to manipulate markets. While the US situation is not the same (non-voting shares), the risk of creeping influence is real. Unless strict laws were put in place to prevent favoritism or intervention, and such laws are unlikely, the danger remains.

This brings me back to a larger idea. The United States has an opportunity to reshape its financial infrastructure in a way that avoids these conflicts altogether. Consider Social Security. At present, the trust funds mostly hold US government bonds, which provide stability but low returns. Imagine instead if those funds owned a total US stock market index. That would align the trust directly with the strength of the American economy. Everyone would benefit when the economy as a whole performs well. The incentive would be to keep America strong. By contrast, owning individual company shares creates misaligned incentives and invites political entanglement. I hope we do not pursue that path.

I am reading a book called Life 3.0 by Max Tegmark. I wanted to share this excerpt because I found it both timely and fascinating.

Since the pace of technological progress appears to be accelerating, laws need to be updated ever more rapidly, and have a tendency to lag behind. Getting more tech-savvy people into law schools and governments is probably a smart move for society. But should AI-based decision support systems for voters and legislators ensue, followed by outright robo-legislators?

How to best alter our laws to reflect AI progress is a fascinatingly controversial topic. One dispute reflects the tension between privacy versus freedom of information. Freedom fans argue that the less privacy we have, the more evidence the courts will have, and the fairer the judgments will be. For example, if the government taps into everyone’s electronic devices to record where they are and what they type, click, say and do, many crimes would be readily solved, and additional ones could be prevented. Privacy advocates counter that they don’t want an Orwellian surveillance state, and that even if they did, there’s a risk of it turning into a totalitarian dictatorship of epic proportions. Moreover, machine-learning techniques have gotten better at analyzing brain data from fMRI scanners to determine what a person is thinking about and, in particular, whether they’re telling the truth or lying.

If AI-assisted brain scanning technology became commonplace in courtrooms, the currently tedious process of establishing the facts of a case could be dramatically simplified and expedited, enabling faster trials and fairer judgments. But privacy advocates might worry about whether such systems occasionally make mistakes and, more fundamentally, whether our minds should be off-limits to government snooping. Governments that don’t support freedom of thought could use such technology to criminalize the holding of certain beliefs and opinions. Where would you draw the line between justice and privacy, and between protecting society and protecting personal freedom? Wherever you draw it, will it gradually but inexorably move toward reduced privacy to compensate for the fact that evidence gets easier to fake? For example, once AI becomes able to generate fully realistic fake videos of you committing crimes, will you vote for a system where the government tracks everyone’s whereabouts at all times and can provide you with an ironclad alibi if needed?

I do believe that the rollout of robo-judges could make sense in limited scenarios. The same logic applies in medicine, where AI could streamline low-risk, routine diagnoses and treatments to improve efficiency. Over time, trust in these systems may grow. Yet I remain cautious about handing real power to models that are inherently non-deterministic. For me to believe in their fairness and reliability, there would need to be extensive structure, rigorous testing, and ongoing validation. Just as importantly, the underlying code and methods would need to be open source - transparent enough to withstand scrutiny from the public and experts alike. Without that level of accountability, the risks may outweigh the potential efficiency gains.

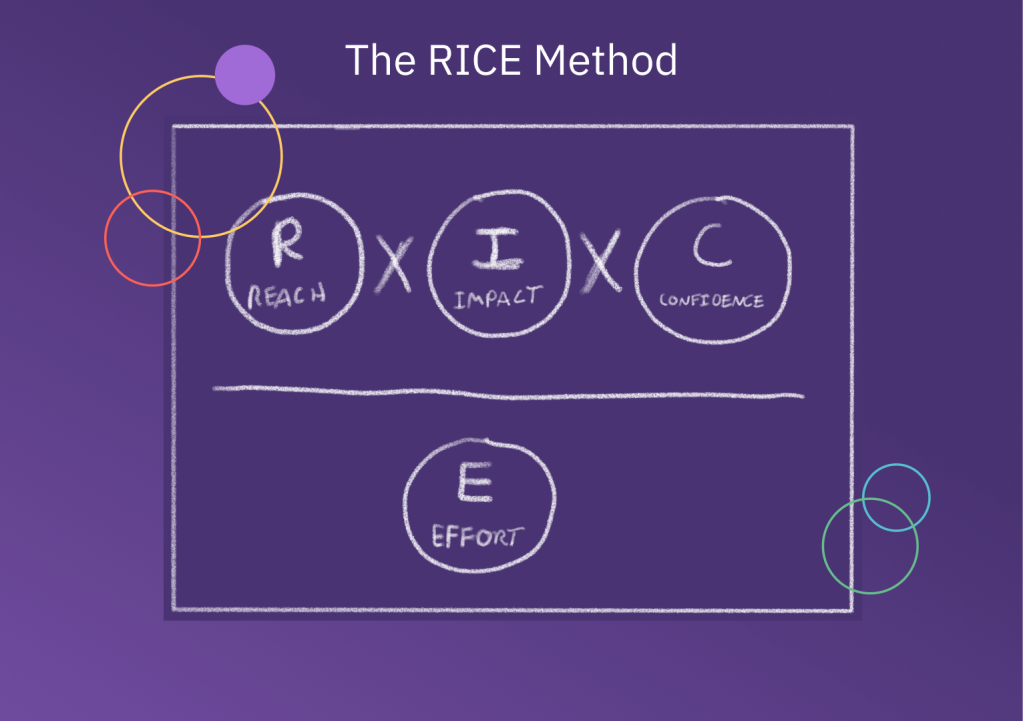

I recently read this article. The author frames urgency as the degree to which a delay reduces long term value and argues that it is a neglected part of strategy. Classic scoring systems like RICE, ICE, MoSCoW, and WSJF emphasize value and effort but rarely make time the primary lever, which pushes teams to treat urgency as purely reactive. The useful shift is to practice proactive urgency, which means acting early to lock in network effects, shape the playing field, and control tempo. When teams routinely ask where waiting helps, where delays erode value, and how to get time working for them, prioritization becomes a strategic tool rather than a firefighting ritual.

This clicked for me because every homegrown prioritization equation I built at past companies felt incomplete. The missing variable was time. Finance solves this with the time value of money, which says a dollar today is worth more than a dollar tomorrow due to opportunity cost and inflation. We convert future cash flows into present value using a discount rate, which makes timing explicit in every decision. Apply that mental model to product work and the value of shipping sooner rises because you capture revenue earlier, learn earlier, and can reinvest earlier, while the cost of waiting compounds.

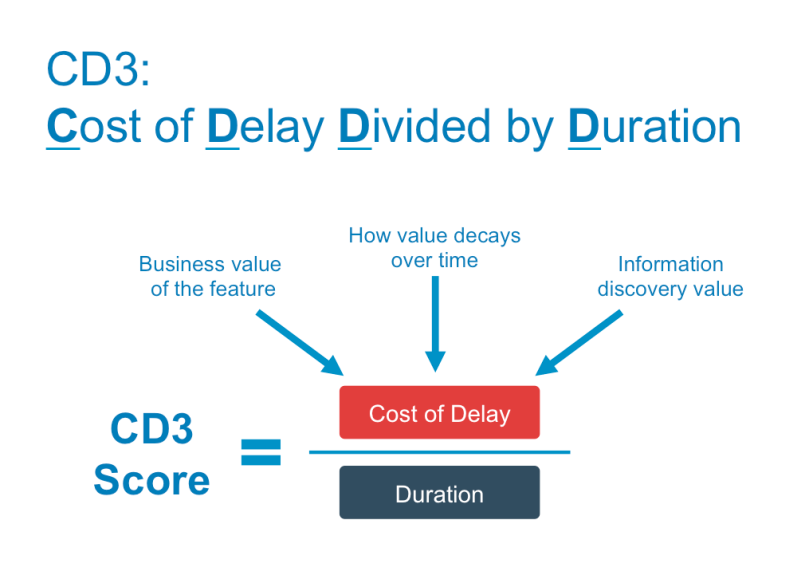

There are several frameworks that already incorporate time. Cost of Delay and its scheduling rule CD3 place time directly in the numerator and divide by duration to rank work. WSJF in SAFe is a widely taught relative version that estimates cost of delay and divides by job size or duration. Kanban uses classes of service and cost of delay profiles to reflect how delay risk grows over time for different work types such as expedite or fixed date. Product teams can also adapt discounted cash flow and net present value from finance to compare initiatives on a common time adjusted basis.

As a base, I recommend CD3 because it is simple, rigorous, and forces explicit time modeling. CD3 equals cost of delay divided by duration. Cost of delay should be expressed in the same currency per unit time for every item, such as dollars per week. Start by quantifying value lost or deferred per week if you do not ship, including direct revenue, user value or retention risk, and risk reduction or opportunity enablement. Sum those components to get cost of delay. Pick a consistent time unit across the portfolio. Estimate duration as calendar time to deliver, not abstract effort points, using cycle time forecasts or capacity based scheduling. Compute CD3 for each item and stack rank from highest to lowest. If two items have similar cost of delay, the shorter one rises because the denominator is smaller. If you already use WSJF, treat it as a relative CD3 and tighten it by translating the cost of delay components into a numeric currency per week and by using duration rather than story points.

Different companies should tune the formula by tailoring how they estimate cost of delay and duration. A marketplace racing toward a tipping point should weight share capture and learning speed inside cost of delay, since early share creates compounding advantage. A regulated enterprise with fixed compliance dates should use a step function profile where cost of delay jumps if a date is missed and should model penalties and reputational impact explicitly. A B2B subscription product tied to renewal seasons should concentrate value in the quarters when renewals happen and reflect that off cycle delivery has lower present value. A consumer app that depends on weekly active use should let cost of delay reflect retention decay, which makes speed to experiment and iterate materially valuable. Deep research or platform investments should include risk reduction and option value in cost of delay, since earlier learning unlocks more potential follow on bets. Across all cases, keep units consistent, revisit the numbers as facts change, and calibrate with postmortems so that the math reflects your reality rather than wishful thinking.

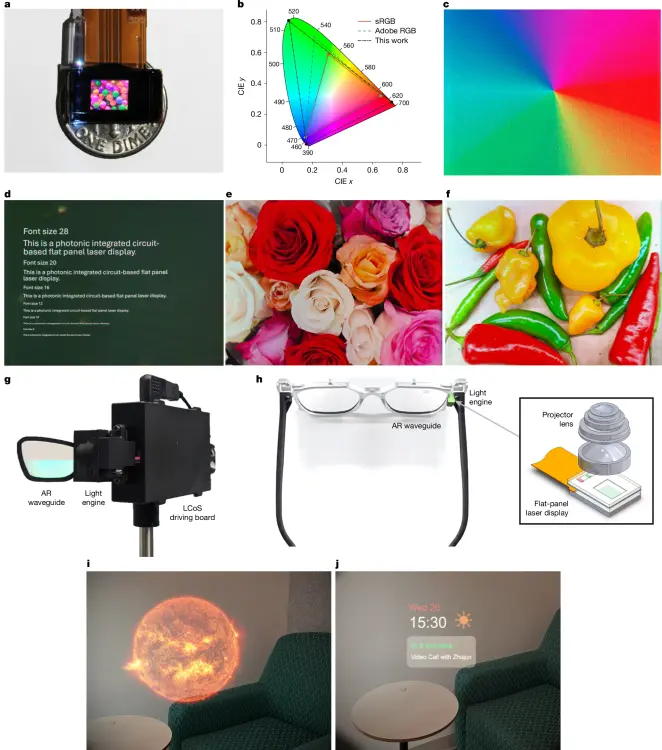

Meta researchers have developed an ultra-thin, laser-based display that could transform augmented reality glasses. The breakthrough uses photonic integrated circuits (PICs) to process red, green, and blue laser light on a single chip, eliminating the bulky projectors that traditional laser displays require. This light is directed onto a liquid-crystal-on-silicon (LCoS) panel, producing a full-color, 1920x1080 resolution image in a display only two millimeters thick. The prototype is just 5mm by 5mm, small enough to sit on a dime, yet still bright and color-accurate enough to work in outdoor conditions. Because the PICs are manufactured with CMOS-compatible processes, the displays could be produced affordably at scale. Meta envisions the technology as a stepping stone from today’s smart glasses to lightweight, all-day AR eyewear that looks and feels like regular glasses, advancing the long-standing dream of mainstream augmented reality. Read a comprehensive article here.

SpaceX’s 10th test flight of its Starship rocket marked a major milestone after a string of failures, as the two stage vehicle successfully reached space, deployed dummy Starlink satellites, reentered Earth’s atmosphere, and simulated landings for both the Super Heavy booster and the upper stage spacecraft. The mission achieved most of its objectives, including proving improvements to the heat shield and satellite deployment system. Some technical issues occurred, like a booster engine shutdown and damaged flaps during reentry, but the rocket maintained control throughout. The test restores confidence in SpaceX’s break it and fix it development approach and is a relief for NASA, which depends on Starship as the lunar lander for its Artemis III mission. Still, delays mean Artemis is unlikely to launch before 2028, and China may reach the moon first. SpaceX’s next big challenges include in orbit propellant transfer and sustaining a faster launch cadence to stay on track for future Mars and moon missions. Read a comprehensive article here.

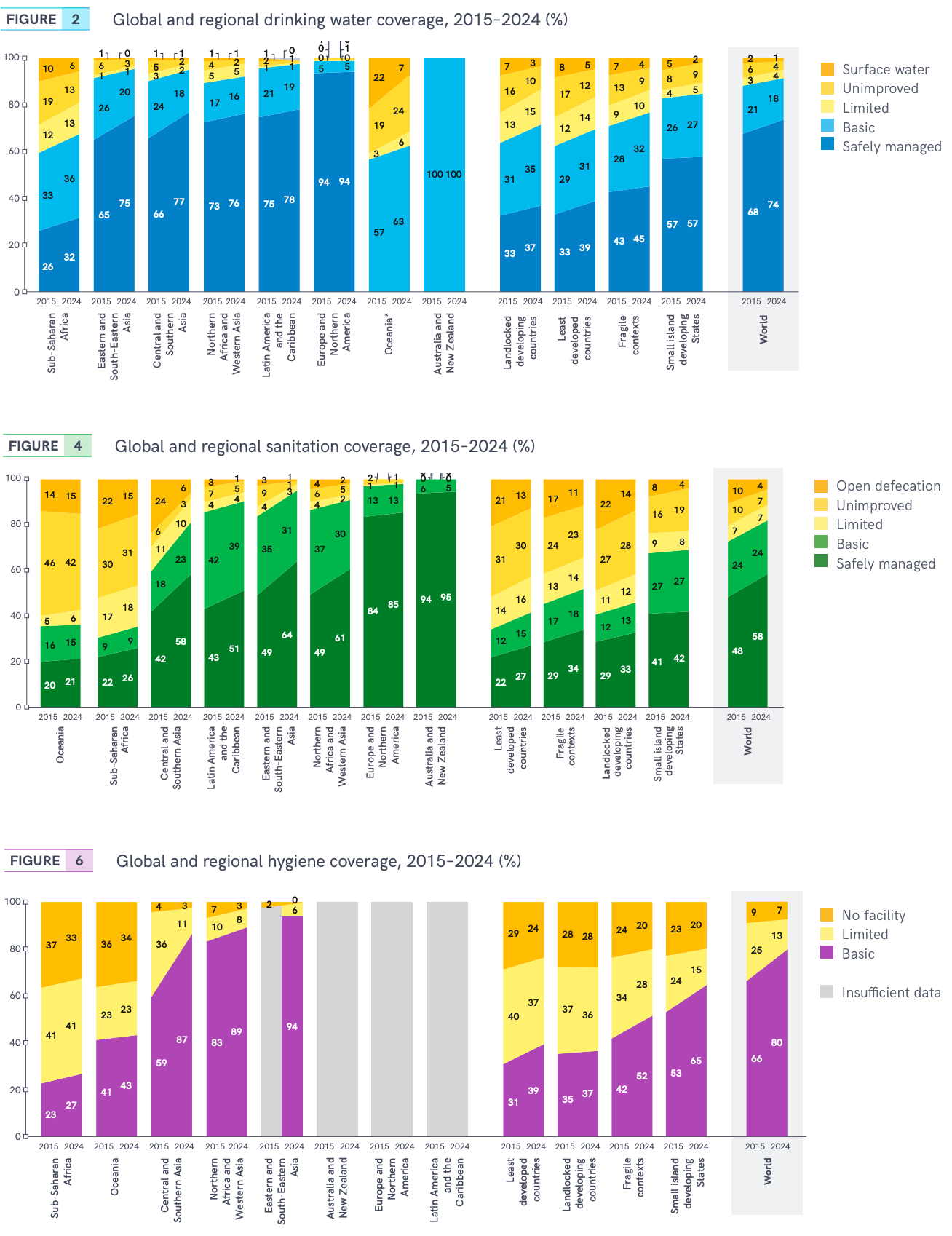

In less than a decade, billions of people have gained access to clean water, sanitation, and hygiene. According to new data from WHO and UNICEF, humanity has just recorded one of the fastest improvements in basic welfare in history. Since 2015, 961 million people have gained safe drinking water, 1.2 billion have gained safe sanitation, and 1.5 billion now have access to basic hygiene. The number of people without these essentials has dropped by nearly 900 million. Today, coverage stands at 74% for safe water, 58% for sanitation, and 80% for hygiene, while open defecation has fallen by 429 million people. These milestones mark a historic leap forward for global health and human dignity.

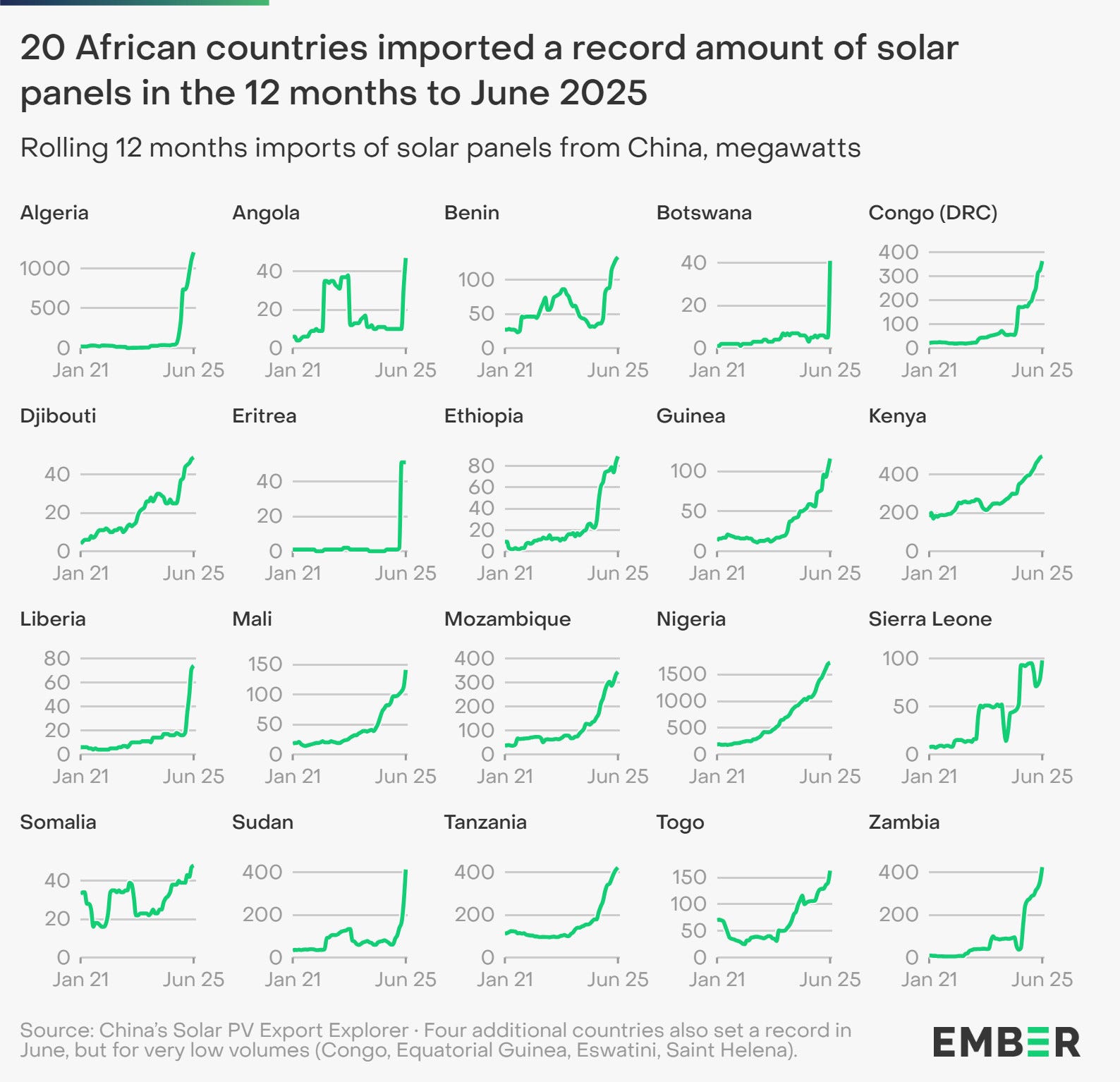

Solar power is surging across Africa. In the year leading up to June 2025, the continent imported more than 15GW of solar panels, with 20 countries setting new records. In Sierra Leone alone, imports in just one year equaled ~61% of the nation’s total electricity capacity — a striking sign of how rapidly solar is reshaping Africa’s energy future.

Wildfires may feel more threatening than ever, but the global picture tells a different story. Between 2002 and 2021, the total area burned worldwide actually dropped by 26%. The rise in fire-related headlines often reflects expanding human settlements near wildlands — making fires easier to encounter and ignite — yet advances in prevention and response have also made them far easier to contain.

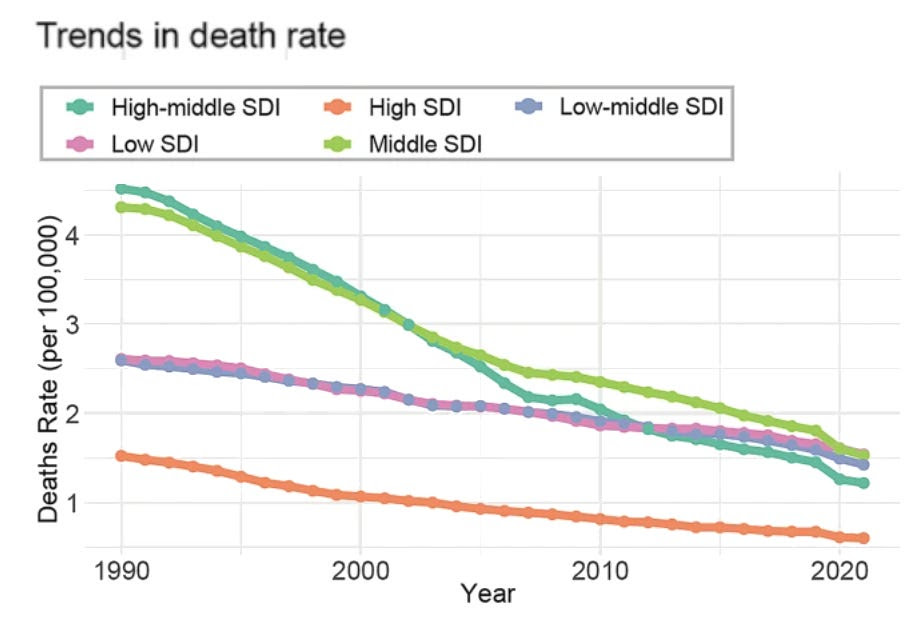

Global deaths from childhood leukemia have dropped dramatically since 1990. Once the leading threat among childhood cancers — responsible for up to a third of cases — leukemia is now far less deadly. A new analysis shows mortality rates fell from 3.35 to 1.38 per 100,000 children between 1990 and 2021, a 59% decline overall, with the steepest drop (70%) in children aged 2 to 4.

Enjoying The Hillsberg Report? Share it with friends who might find it valuable!

Haven't signed up for the weekly notification?

Subscribe Now